XRP news from the additional letter submitted by Ripple on June 17, 2025, added to the indicative ruling power, which promoted the progress of settlement in the SEC vs. Ripple case.

The letter explains that no party was interested in varying the Summary Judgment Order that had been given.

XRP News: Ripple’s Legal Push, A Step Closer to Resolution?

Ripple pointed out that the dissolving of the injunction to obey the law would not make them free from the securities law, and this puts them in tandem with other bodies in the market.

Another point in the letter also indicated the change in regulation, which was the focus of the SEC through the crypto task force, to which Ripple was supportive. If approved, the settlement would alleviate legal problems and complete one of the longest crypto cases in history.

In the case of XRP news, it was an indication of less legal risk and one that may lead to increased institutional participation and luminosity in the United States market.

The fact that Ripple was eager to adhere and take part in the regulatory involvement strengthens the argument as to why XRP will survive in the long run.

The resolution of this motion might have been the factor that dictated whether or not Ripple manages to leave its case with a better understanding of its regulatory status, therefore, contributing to the fresh belief in the legal and marketplace presence of XRP.

Also Read: Dogecoin (DOGE) Rally Imminent? Chart Flashes Bullish Divergence

XRP Price Outlook: $6 in Sight?

XRP’s bullish Elliott Wave pattern finished with an escape from the Wave 4 triangle, clearly indicated by the trendline of the breakout. This proved that a significant change in market structure occurred.

After the 5-impulse impulse of the sub-$0.40 region to above $2.80, XRP produced a textbook 1-2 corrective swing back in price, of which it remained above the pivotal structure near $1.70.

The structure was still in place, and until the market crusts down decisively below that support, the bullish thesis will dominate.

With an all-time low in place, it put wave 3 as an ultra-bullish swing, with a target of $6 to $13, becoming very believable.

Once XRP overtakes the $2.80 to 3.50 resistance block, the momentum is expected to gain run to $6+ as indicated in the projection.

The breakout also would create Wave 3 utilities and potentially put XRP on the path to attack the highest target of $16 to $25 farther down the path.

At the moment, XRP is building up in an optimistic outline. The prospects are positive as long as there is no failure of the $1.70 region. A macro continuation has got better chances with targets well into double figures.

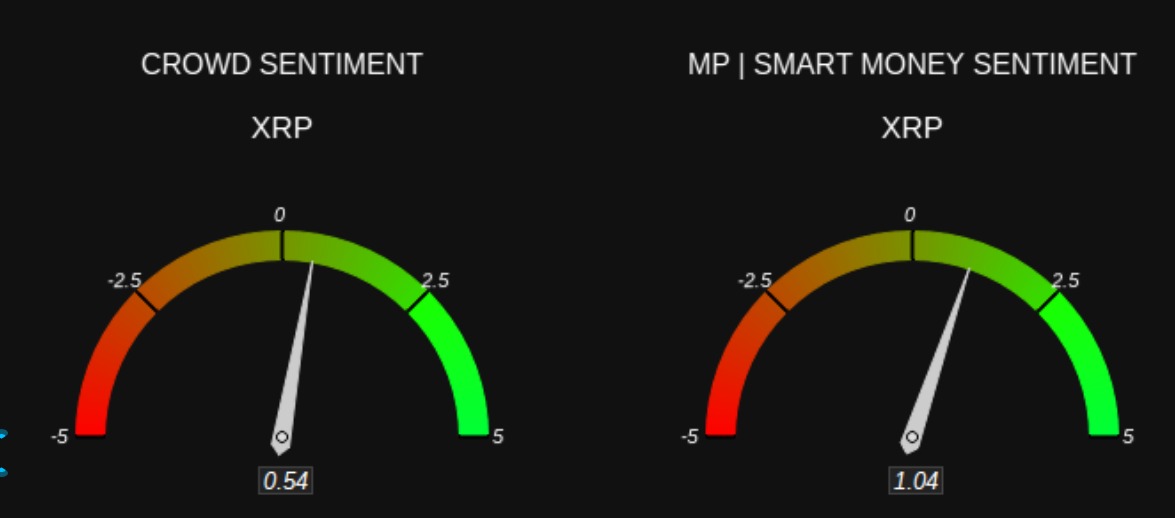

Sentiment Snapshot: Retail vs Smart Money

The XRP sentiment indicator shows a somewhat bullish look or look by retail participants and the smart money participants. The crowd sentiment was 0.54, very slightly above neutral, indicating the initial bullish bias by the retail traders.

This was a positive sign, perhaps as a result of recent mergers of prices and the wait-and-see attitude the market had taken.

In the meantime, smart money sentiment is more pronounced at 1.04, which shows more institutional or experienced confidence.

This increased reading results in strategic hoarding or faith in XRP macro-potential, particularly after several forms of wave construction and breakouts extending triangles in the technical diagrams recently.

The more institutional sentiment is slightly more upbeat on the outlook of a continuation rally relative to the sentiment of the crowd.

In the past, these patterns have been the threshold to buying on an uptrend as retail lags.