Trump Media’s Truth Social has officially entered the crypto ETF race with a filing that targets top digital assets. The company submitted an S-1 registration with the SEC for a “Crypto Blue Chip” ETF, broadening its push into digital finance.

The ETF will offer exposure to Bitcoin, Ethereum, Solana, XRP, and Cronos. It aims to appeal to investors looking for regulated access to crypto without direct token ownership.

It is looking to list the ETF on NYSE Arca, a platform known for crypto-related fund listings. The product will be managed by Yorkville America Digital and use Foris DAX, affiliated with Cryptocom, as custodian.

ETF Portfolio and Allocation Strategy

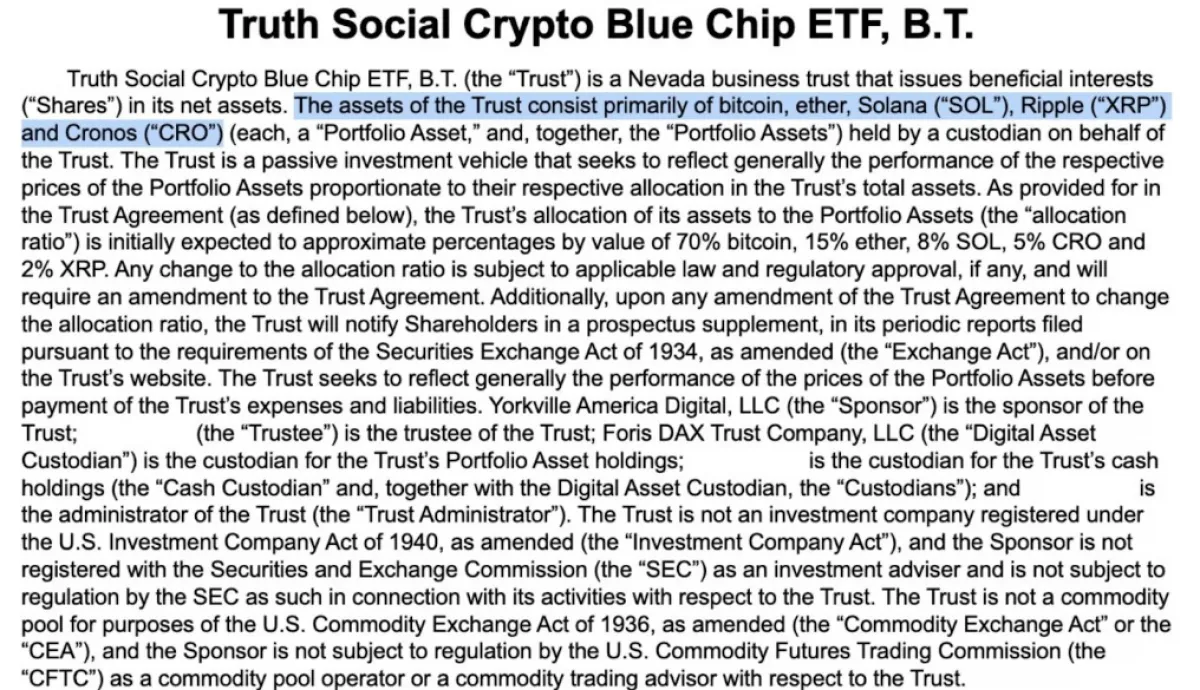

The Truth Social Crypto Blue Chip ETF will be a passive investment fund holding a basket of five digital assets. The initial allocation sets Bitcoin at 70%, Ethereum at 15%, Solana at 8%, Cronos at 5%, and XRP at 2%. These weights are designed to reflect the market dominance and liquidity of each asset.

The ETF will issue and redeem shares in blocks of 10,000, a common format for exchange-traded products. At launch, creations and redemptions will be processed exclusively in cash. The prospectus notes that “in-kind transactions may follow, pending regulatory approval.”

The ETF will be benchmarked using pricing data from CF Benchmarks and CME indices. Rebalancing will occur quarterly to maintain target weightings. Any future changes to allocations will require SEC amendments and additional approval processes.

Sponsorship and Operational Infrastructure

Yorkville America Digital is listed as the fund sponsor and brings prior experience from earlier ETF filings tied to Truth Social. The firm also backs its standalone Bitcoin ETF and Bitcoin-Ethereum hybrid ETF proposals, which remain under SEC review.

Foris DAX Trust Company, part of the Crypto.com ecosystem, will act as both custodian and liquidity agent for the fund.

The fund will be structured as a Nevada business trust and will function to mirror the performance of its underlying crypto assets. The custodian will manage the safekeeping of digital assets and handle secure storage and transaction management. Liquidity operations will ensure the ETF trades in line with its net asset value.

The filing also verifies that any subsequent amendment in the asset allocations will have to undergo SEC review and formal amendment.

This guarantees transparency and regulation in the development of the fund. This submission also indicates the current strategy of Truth to expose retail and institutional investors to crypto via mainstream financial platforms.

Also Read: New Tariffs Incoming? Trump’s Trade Tsunami

Broader Strategy and Industry Context

The filing of Truth is also part of its overall strategy to create a digital asset-based investment franchise. It follows the company’s other S-1 filings for a spot Bitcoin ETF and a dual Bitcoin-Ethereum ETF, signaling an aggressive approach to crypto finance.

These filings are consistent with the Trump administration being more amenable to regulations of digital assets.

The SEC recently acknowledged the dual-asset ETF application, triggering the official review timeline. This momentum suggests the agency may accelerate reviews of crypto-related ETFs amid rising demand. Truth Social appears positioned to benefit from this policy shift and aims to be at the forefront of crypto ETF offerings.

Increased interest in regulated crypto investment products is also represented by competitor filings by Grayscale, Bitwise, Franklin Templeton, and REX Shares. Several of these firms are applying for ETFs focused on tokens like Dogecoin, Cardano, Solana, and Litecoin. The Truth Social ETF may stand out due to its direct brand alignment with the Trump Media and “America First” narrative.

Cronos, one of the fund’s tracked assets, has faced scrutiny after Crypto.com approved a controversial reissuance of 70 billion CRO tokens. Nonetheless, its presence is an indicator of the strategic fit of Truth Social with the Crypto.com ecosystem. That relationship is further reinforced by Foris DAX’s role in managing the ETF’s backend.

The filing is an indication that Truth Social intends to increase its presence in online markets. If approved, the ETF would offer investors a diversified, regulated entry point into blue-chip crypto assets through traditional financial infrastructure.