In the wake of June 13th, the U.S. Securities and Exchange Commission demanded that Solana ETF issuers update their filings. The move resulted in a spike in the asset’s price as traders saw optimism in potential approval.

Solana ETF News Updates

The institutional momentum behind SOL was also building up with Invesco and Galaxy Digital having filed for the Solana ETF in Delaware.

Traditional finance (TradFi) participants are rapidly entering the crypto ETF space. Delaware has emerged as a key venue for early-stage ETF approvals. This step by Invesco Galaxy was significant given that Galaxy was among the biggest institutional owners of SOL.

In conjunction with this, two revised proposals of Solana ETF were filed with the SEC by SOL Canary Capital and Bitwise.

The regulator has now started reviewing these filings actively. This can be seen as a shift from passive supervision to operational intervention.

Issuers were awaiting edits. Also, various sources indicated that the SEC may issue a decision in 3-5 weeks, or even by mid-to-late July 2025.

The creation of this was a major inflection point in terms of the legitimacy of Solana in institutional portfolios. A publicly listed Solana ETF would provide broader market access. Retail and institutional clients could gain exposure to SOL without direct ownership.

Similar to the case of BTC and ETH ETFs, regulatory acceptance may drive significant price and volume growth for SOL.

How Price Reacted to Solana ETF News

Solana was among the coins that reacted the most to the SEC demanding that ETF issuers amend their filings. The price climbed above $165, creating a new wave of bullish mood.

The above-mentioned break above the critical 200 SMA resistance at $168 was becoming more and more probable. This supports the short-term bullish analysis.

The optimism among investors also gathered pace as the US and China continued to hold talks, and markets were expecting some positive sentiments.

The volume gathered momentum as SOL touched the $168 mark, with the next resistance level at $185. In case of further momentum, the target of 250 can be reached.

Nonetheless, any rejection at the $168 would put the rally on hold. Hence, this level is essential to the onward uptrend of SOL.

Also Read: HBAR News: ETF Delay Triggers Panic, Will $0.154 Hold?

Solana On-Chain Performance

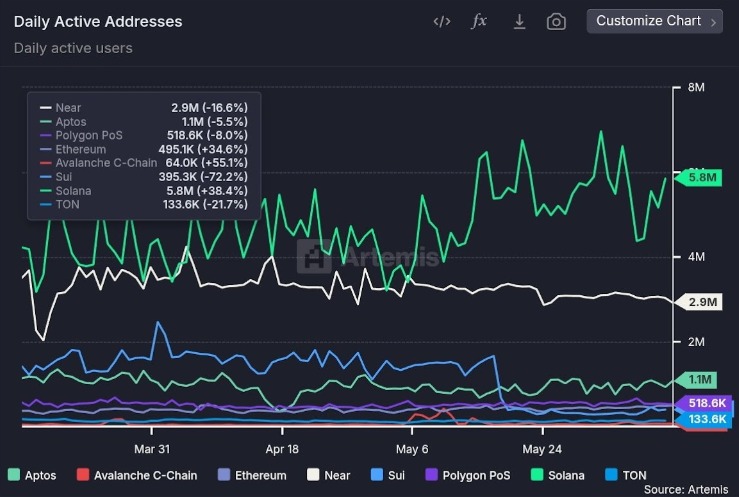

Despite a win in potential Solana ETF approval, SOL also dominated the on-chain activity. It currently leads all other chains regarding daily active addresses and daily transactions.

Recent data from Artemis showed that SOL had 5.8 million daily active addresses, an increase of 38.4%. This left NEAR with 2.9 million (-16.6%) and Ethereum with 495.1K (+34.6%) far behind. Others, such as Polygon PoS, were at 518.6K (-8.0%), and Aptos at 1.1 million (-5.5%).

Solana led daily transactions of 99.5 million, which displayed a 16.1% upward push. NEAR was the next closest with 2.9 million transactions as well; however, this was a sharp 30.7% decrease.

Aptos experienced a 43.8% increase in transactions to 1.1 million, whereas Ethereum had 495.1K transactions, an increase of 22.8%.

Avalanche C-Chain reported a significant 198.3% increase in transactions to 64.0K. However, it still has a long way to go to compete with Solana in terms of volume.

Solana’s rising deal volume and transaction statistics reinforce its widespread adoption. Users and developers continue to favor its blockchain for various applications. This growth positions Solana on a strong trajectory, attracting even more contributors.