SharpLink Gaming has overtaken the Ethereum Foundation in total ETH holdings, becoming the largest entity in the Strategic Ethereum Reserve. The shift occurs amid a sharp increase in institutional demand for Ethereum, as evidenced by rising ETF inflows and robust on-chain metrics.

SharpLink Gaming Becomes Largest ETH Holder

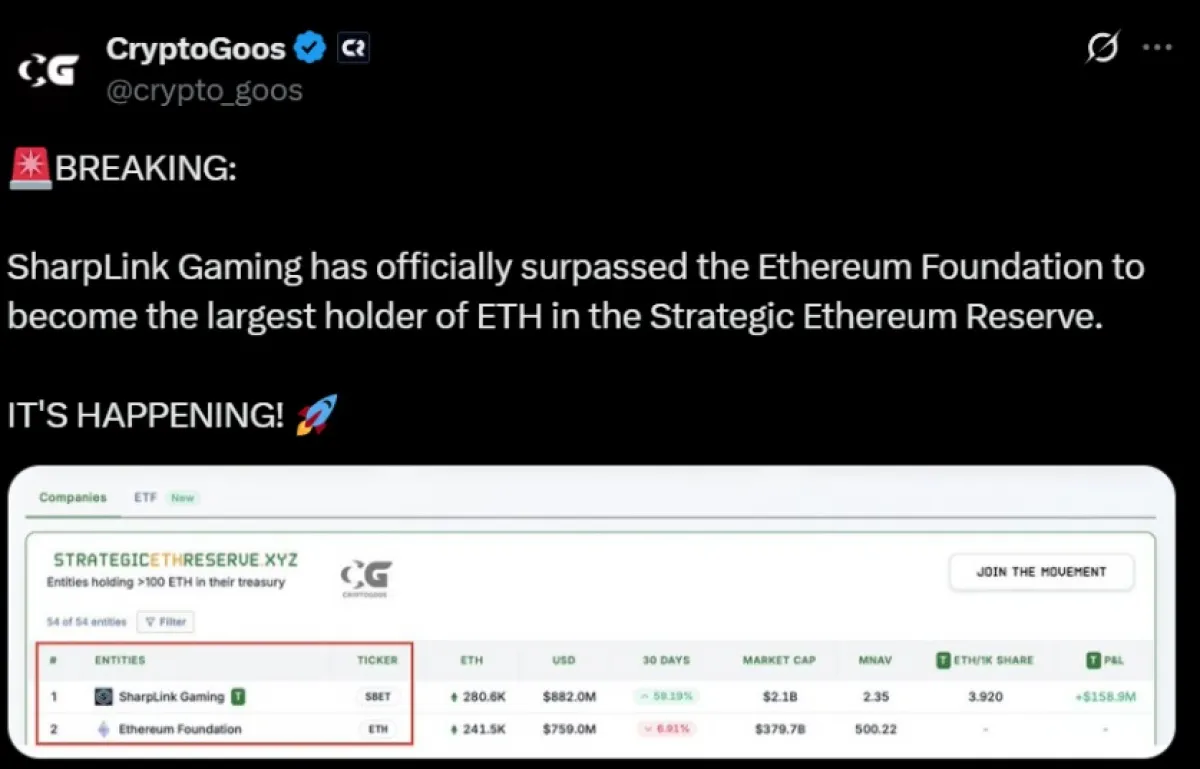

According to the latest data, SharpLink Gaming now holds 280,600 ETH, valued at approximately $882 million. The Ethereum Foundation holds 241,500 ETH, worth an estimated $759 million, placing it second in the current rankings.

SharpLink’s ETH holdings have increased by 59.19% over the last 30 days. In contrast, the Ethereum Foundation recorded a 6.91% decline in terms during the same period. SharpLink’s current market capitalization stands at $2.1 billion, making its ETH allocation a large portion of its corporate treasury.

Data also shows that SharpLink Gaming maintains a Multiple Net Asset Value (MNAV) of 2.35. The company has reported nearly $159 million in unrealized profit on its ETH position, suggesting ETH plays a key role in its long-term asset strategy.

Ethereum ETF Inflows Record Bullish Trend

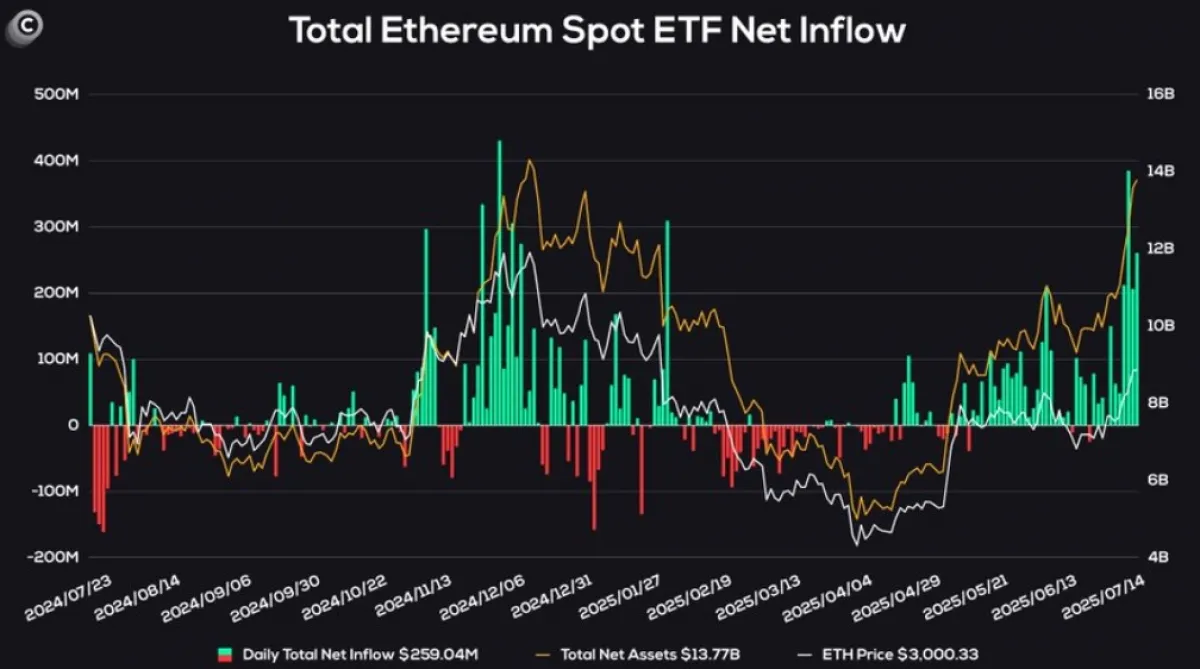

Alongside treasury activity, Ethereum is also seeing a surge in institutional interest in spot exchange-traded funds (ETFs). Net inflows for spot ETH ETFs have now reached eight consecutive days, with a recent daily peak of $259 million. This marks the highest single-day inflow in over a year.

The Total Ethereum Spot ETF Net Inflow chart shows daily inflows in green bars, while the orange and white lines track total assets and ETH spot price, respectively. Total ETF assets have now reached $13.77 billion. At the same time, ETH has reclaimed the $3,000 level, suggesting that inflows are driving asset price recovery.

Historically, sustained ETF inflows have been associated with rising prices. With capital entering both company treasuries and ETFs, Ethereum appears to be gaining stronger traction among institutional investors.

Also Read: Standard Chartered Opens BTC & ETH Spot Trading for Institutions

Ethereum Price Forms Bull Flag, Eyes $4,000 Breakout

According to market analyst LordOfAlts, Ethereum is forming a bullish continuation pattern known as a bull flag on the daily chart. This technical framework implies that it may have a breakout to the long-term price level of $4,000.

The chart provides three periods that can be characterized as early consolidation in April, the aggressive rally creating the flagpole, and this sideways consolidation in June-July. Ethereum has recently exited the second range of consolidation, indicating that a new bullish force has emerged. The breakout has been supported by strong daily candles and higher lows.

Before this move, a fakeout briefly pushed the price below support before quickly recovering, a pattern often seen in healthy uptrends. This recovery has added strength to the setup and reduced selling pressure.

As long as ETH remains above the $2,900–$3,000 level, the structure is likely to hold. The analysis points to a continuation of the trend, with Ethereum targeting the $4,000 level in the coming weeks if momentum continues.

On-Chain Metrics Reflect Strong Ethereum Fundamentals

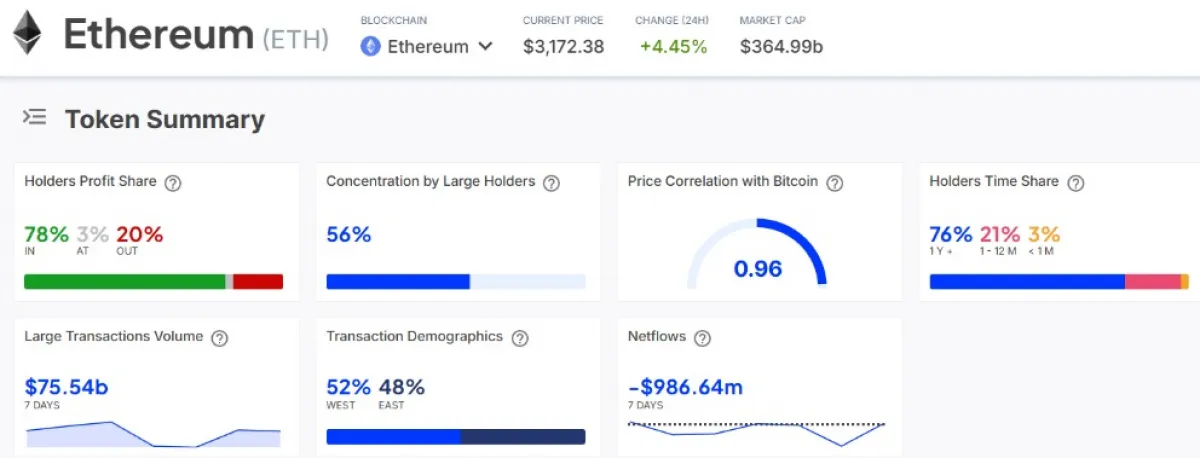

Ethereum’s on-chain data continues to reinforce the growing interest from institutional investors and long-term holders. As of mid-July, approximately 78% of ETH holders are in profit, a figure that typically signals strong holding conviction. With most of the holders profitable, chances of mass panic selling are likely to decline, supporting price stability in bullish cycles.

Additionally, 76% of the supply of Ethereum has been held for more than one year, which shows that long-term positioning is held by most investors. Such high levels of commitment minimize the short-term volatility because long-term holders are not easily convinced by fluctuations in the price or short-term news cycles.

There is also an increase in the large-scale volume of transactions. In a week, a volume of ETH amounting to $75.54 billion was changed with high-value transfers, which could be linked to institutional wallets. This activity implies a longer-term interest in larger players, especially with Ethereum gathering more use in financial instruments such as ETFs and treasury holdings.

Large holders now control 56% of the Ethereum total supply, which means that there is a reliable accumulation of the supply by large funds. Over the past seven days, exchanges recorded net outflows totaling $986.64 million, suggesting that ETH is being moved into long-term storage rather than positioned for short-term selling.