The cryptocurrency markets continue to get embraced across the globe, with the new entrant being Japan, which by default has strict guidelines on listing tradable assets.

With a Japan-based bank exploring stablecoin issuance on Solana [SOL], the blockchain could not get more traction than this. In the meantime, more reasons are building up as to why Solana could continue dominating more in Q3 of 2025. However, can this hypothesis hold?

Solana Adoption Picks Up in Japan

As Minna Bank plans to release stablecoins on the Solana network, it could be taken as a sign of increasing institutional appeal toward Solana.

Allowing the bank to collaborate with Fireblocks and Solana will enable it to evaluate the application of stablecoins to routine payments, trading of tokenized RWA, and Web3 wallets.

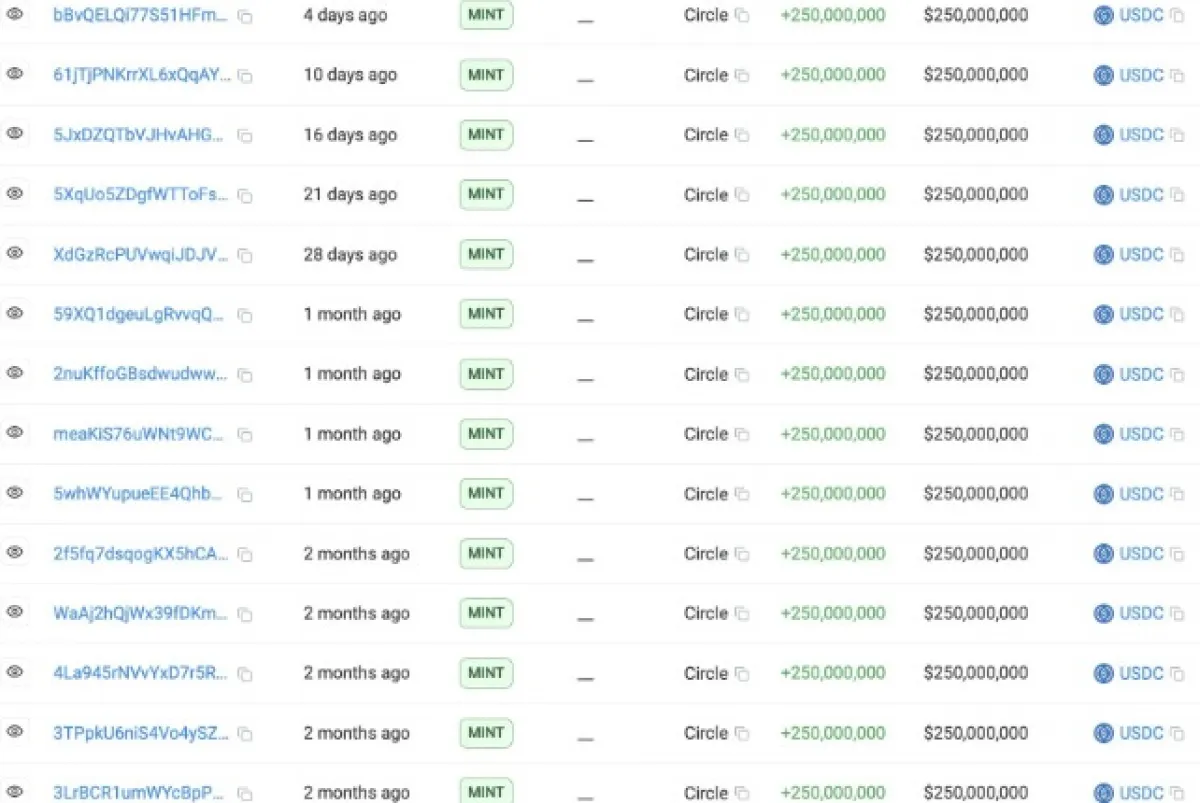

This makes Solana a major platform in a new generation of financial developments. Minna Bank’s exploration was backed by Circle’s massive mint for Q2 2025, which was a total of 5.5 billion tokens.

This steady minting meant that there was a large stablecoin demand and utilization on the Solana chain. The exploration of Minna bank could benefit SOL, thus stablecoin quantity and industrial experimentation could start to arise in Q3.

Most key trends in DeFi and payment utility revolve around stablecoins, and that is why Solana and its high throughput and cheap transactions are a perfect match to this growth. Such progress would be positive, just like the bullish movement in the quarterly performance of Solana.

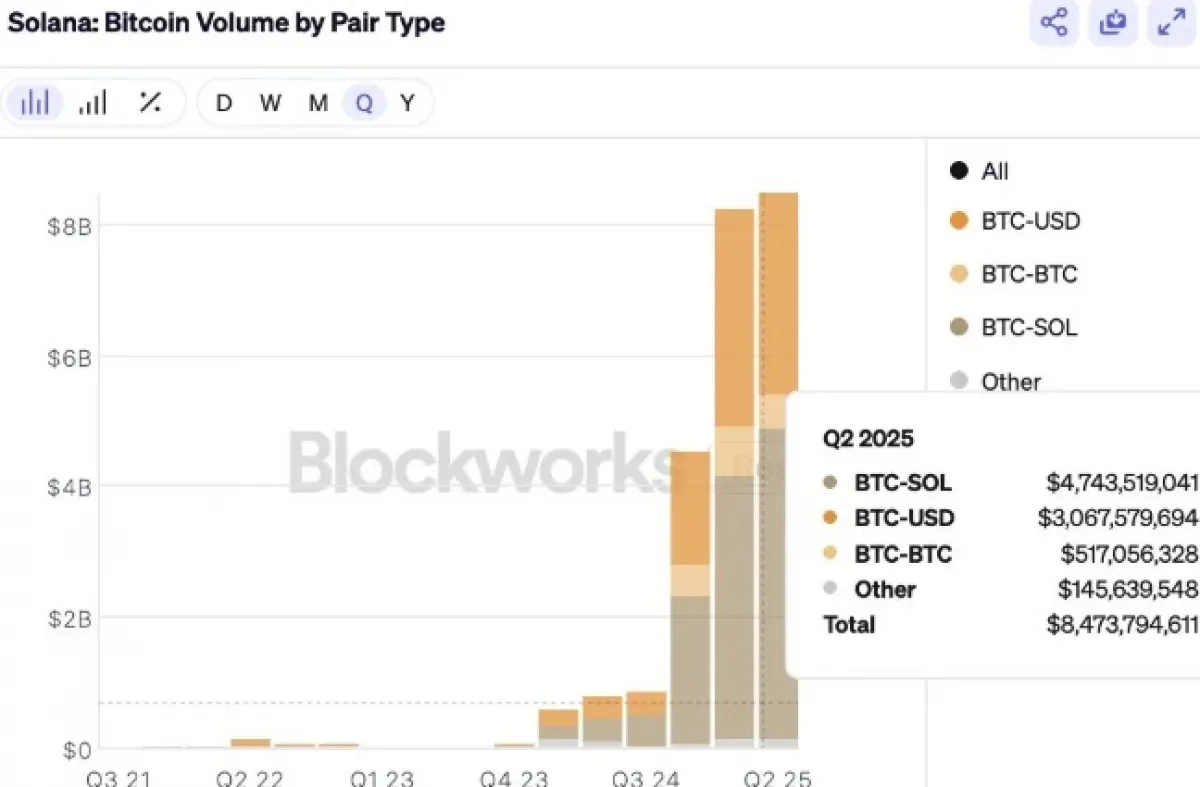

BTC-SOL Trading Volume Surges

Additionally, Bitcoin [BTC] trading on the Solana blockchain rose above Q1 volume with a value of $4.74 billion for BTC-SOL in Q2 2025, setting a new trading record. This value outpaced both BTC-USD and BTC-BTC pairs, which were 3.07 billion and 517 million, respectively.

This was a significant change in trading infrastructure, with Solana leading the appearance of this volume between BTC and SOL.

Its data showed that SOL was increasingly becoming attractive in terms of smooth, high-throughput transactions and was increasingly being used in Bitcoin liquidity flows.

At this huge margin, Solana not only ranks higher than other trading pairs, but also has established itself as a trade-label of choice when trading Bitcoin.

This amount of volume increase confirmed the potential that SOL may take over Q3, not only in terms of trading volume but even in terms of price.

In case of activity maintenance or increase, the native token of Solana could enjoy more demand, liquidity, and user confidence.

The competitive advantage in terms of the speed of making transactions and cost-effectiveness granted the Solana network the infrastructure power to keep it going.

This development involving SOL and BTC supported Solana as one of the leaders in this changing crypto environment.

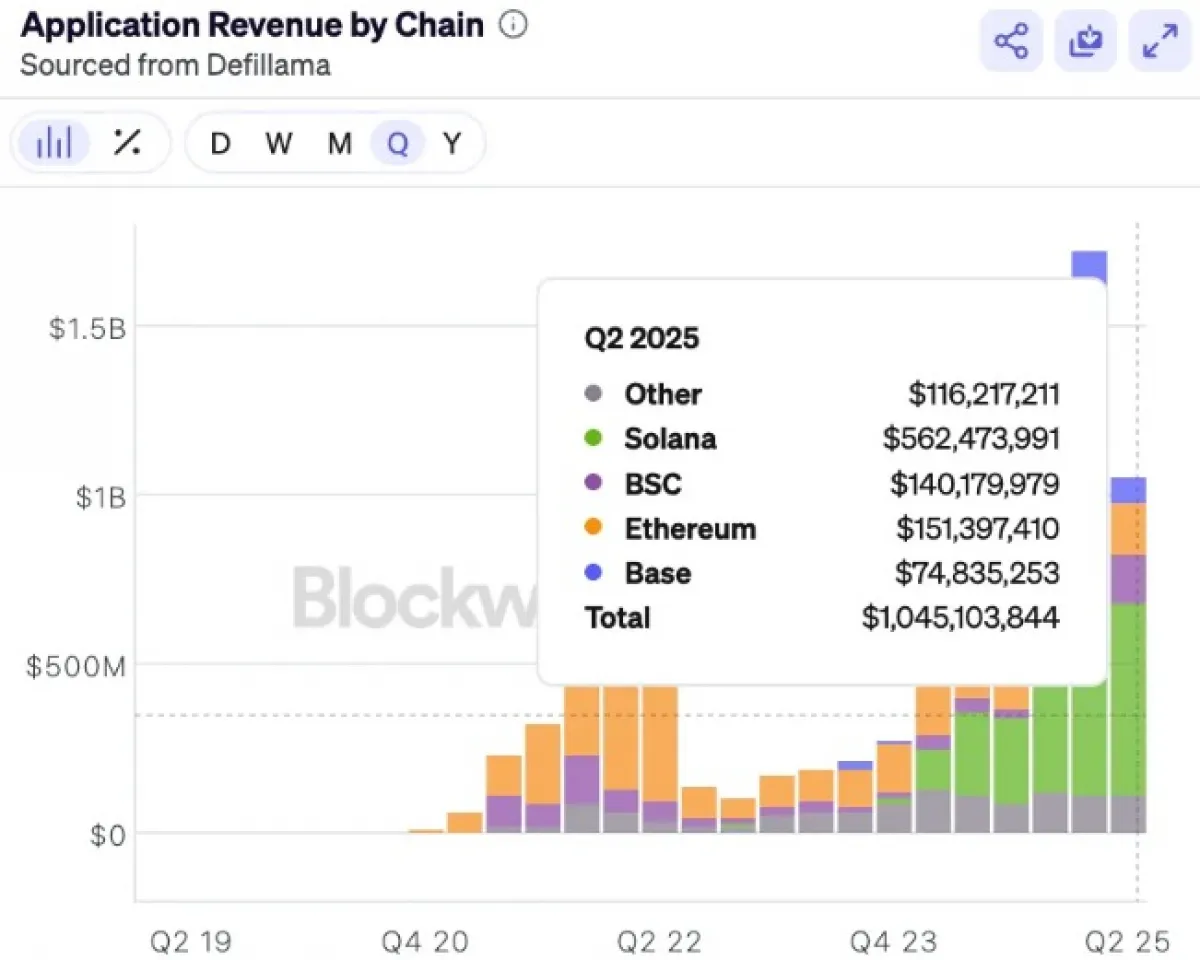

Revenue and Utility Boost SOL’s Outlook

Worth noting, Solana also topped the charts with over $500,000 in utility revenue at the beginning of Q2 2025. This meant more users, especially from memecoin trading and other cheap solutions that the blockchain provides.

It was the fifth consecutive quarter that Solana DApps had earned more revenues than other chains did. The revenue leadership proved the increasing strength of the Solana ecosystem and effective user adoption.

This came along with Solana reaching a new milestone on tokenized stocks (xStocksFi) that had massive volume over the last four days.

It was noteworthy that Solana was behind Ethereum in hosting trading of tokenized stocks. In fact, these great results, both in revenue and new verticals, indicated that Solana could indeed be one of the leading competitors in Q3 2025.

Its uncanny quarterly revenue dominance lent credence to its bullish position, and it continually kept under on-chain fundamentals and active user growth.