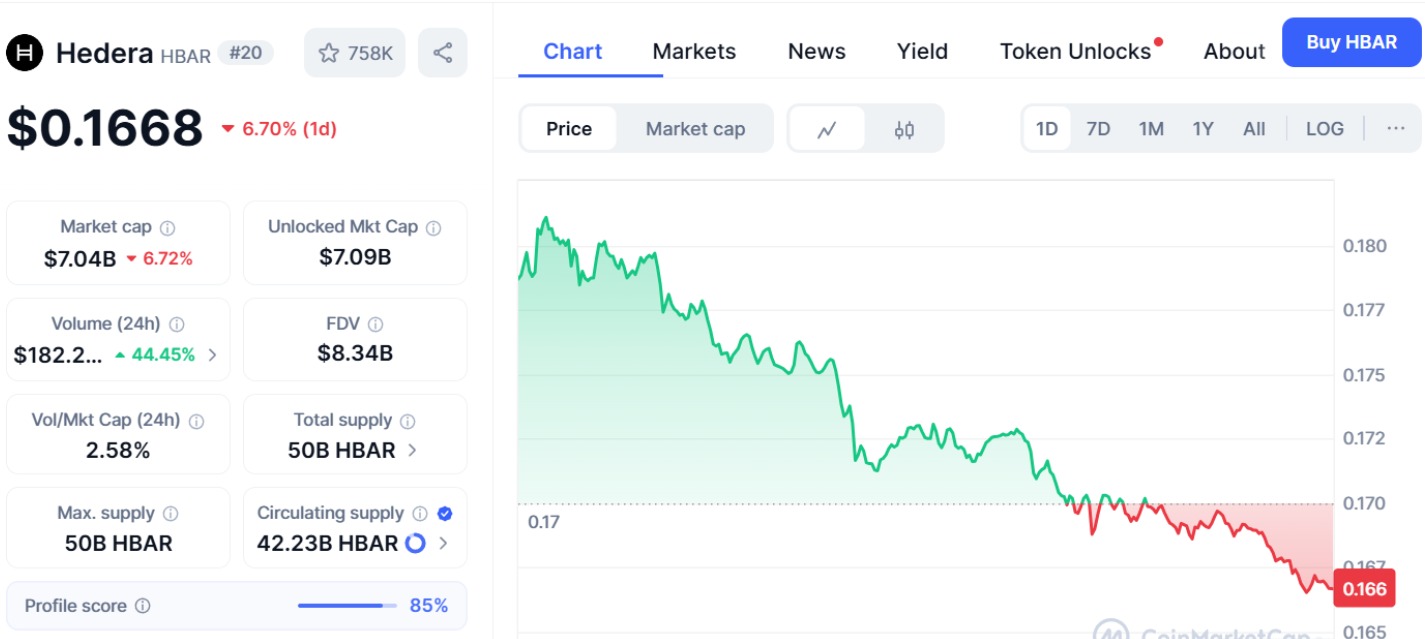

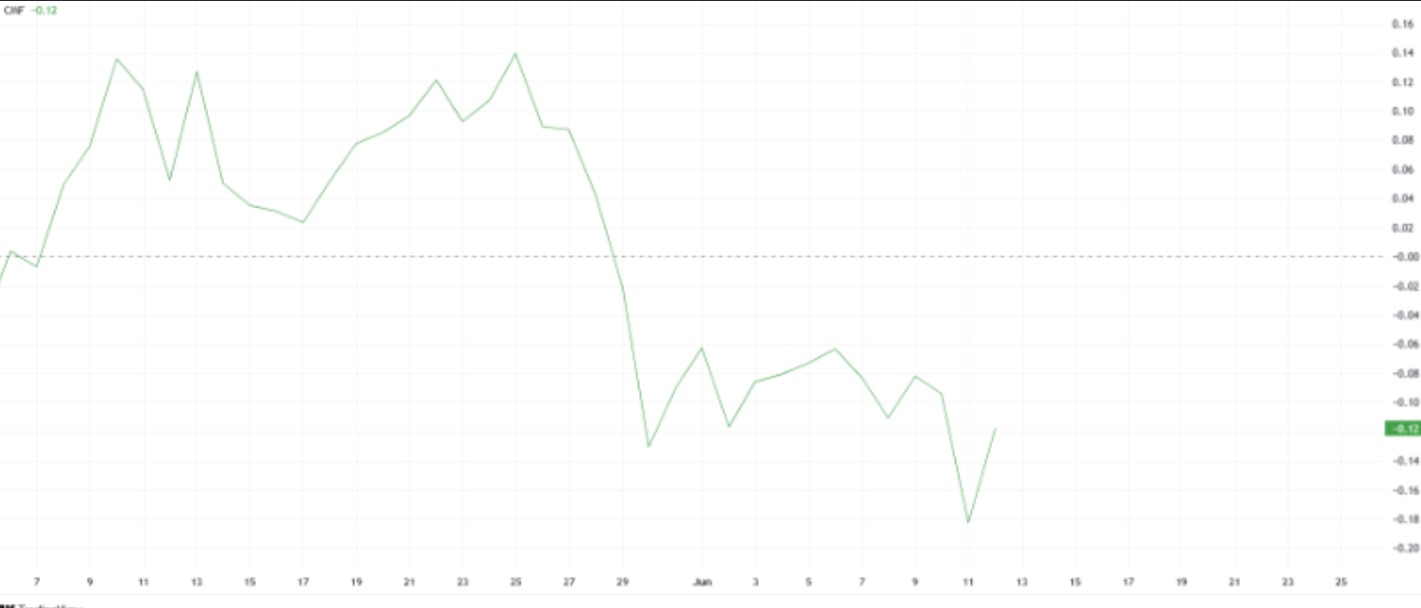

In recent HBAR news, Hedera (HBAR) price fell by 6% over the past 24 hours. As a result, this has brought fears of more downside action. The decline followed a failed attempt to sustain recent gains earlier in the week.

HBAR News: Reversed Gains as Downtrend Persists

Notably, HBAR price saw a short-lived rally at the beginning of the week, gaining as much as 13% before facing renewed selling pressure. The momentum was not enough to escape a persistent month-long downtrend. As a result, the price retreated sharply and is now back to levels seen at the start of the week.

Consequently, the 6% drop within a day has brought HBAR closer to a key support level at $0.167. This level will be closely monitored by traders as a potential inflection point. If selling continues, HBAR may retest lower support at $0.154, marking a new monthly low. The market structure continues to lean bearish as previous attempts to form higher highs have failed.

Bearish CMF Underscores Investor Skepticism

Further on HBAR news, the Chaikin Money Flow (CMF) indicator was in the negative territory, sitting below the zero line. This shift indicated that capital outflows are exceeding inflows, suggesting weakening demand for HBAR. Negative CMF values are typically associated with bearish sentiment and reduced accumulation.

Additionally, investor behavior appeared cautious as sentiment failed to improve despite earlier gains. The lack of strong inflows is further evidenced by the limited volume on green candles compared to red ones on HBAR’s daily chart. Unless inflows return in force, the current trend may persist, placing additional pressure on support levels.

Also Read: Chainlink Price Prediction: Will LINK Hit $20 Next?

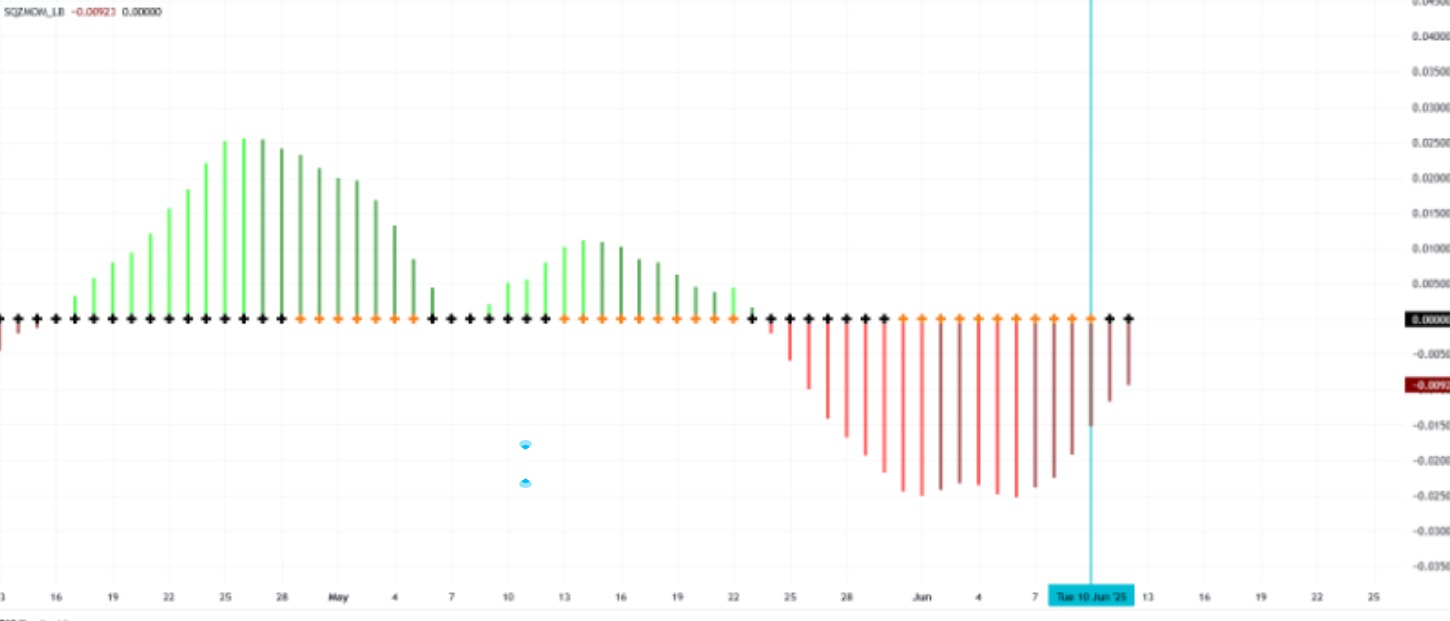

Squeeze Momentum Indicator Signals Volatility Ahead

More so, technical indicators also pointed toward possible price turbulence. The Squeeze Momentum Indicator (SMI) has recently printed black dots, indicating that the market is entering a squeeze phase. This setup often precedes a breakout or breakdown, depending on the direction of momentum that follows.

Currently, the SMI histogram bars remain red, reflecting negative momentum. If this continues, HBAR could face another leg downward, especially if it fails to hold support at $0.163. However, if the bars begin to turn green, it may suggest a change in momentum and open the possibility for a short-term rebound.

ETF Delay Adds Pressure to HBAR News

In other HBAR news, the U.S. Securities and Exchange Commission (SEC) delayed its ruling on the proposed spot HBAR ETF from Canary Capital. This has added pressure to an already fragile outlook for Hedera.

After investors anticipated a verdict by June 11, the abrupt pause and 45-day extension have introduced new uncertainty. This regulatory delay followed a sharp 6% daily price drop and declining investor sentiment, weakening confidence in HBAR’s near-term recovery potential.

Moreover, investors had priced in the possibility of a decision that could inject momentum into the asset. However, with the SEC opting to prolong its review amid broader caution on altcoin-based ETFs, speculative interest has cooled.

HBAR News: Price Recovery Requires Break Above $0.172

For any shift in sentiment to occur, the HBAR price has to rise above the immediate resistance at $0.172. A move beyond this level may mark a break in the short-term downtrend and could pave the way for a test of $0.180.

Additionally, sustained movement above $0.180 may allow the altcoin to revisit $0.188 soon. Until then, the broader outlook is cautious. Without a confirmed breakout or surge in investor demand, the bearish setup continues to dominate.