A recent report on Ethereum (ETH) shows that 1.8 million ETH, worth approximately $6.51 billion, is currently held by only 56 participants. The data suggests a strategic accumulation by institutions or large holders, marking a shift in market positioning.

With Ethereum now trading near $3,700, analysts are closely watching its price trajectory and how this may trigger movements across the altcoin market.

Ethereum Reserve Grows to $6.5 Billion

Recent blockchain analytics confirm that 1.8 million ETH has been moved into a strategic reserve, equivalent to over $6.5 billion in value.

The data indicates that the ETH is controlled by only 56 entities, suggesting accumulation by long-term holders or institutions rather than retail investors. This consolidation points to reduced short-term selling pressure and supports long-term investment strategies.

The reserve now represents 1.46% of Ethereum’s total circulating supply. In a market that often reacts to supply constraints, this level of accumulation could have a direct effect on Ethereum’s price behavior.

Fewer tokens available for trading may lead to increased buying pressure as market activity continues to build.

Also Read: Dogecoin Price Prediction: Will DOGE Rally to $1 in 2025?

Bullish Patterns Support Ethereum Price Action

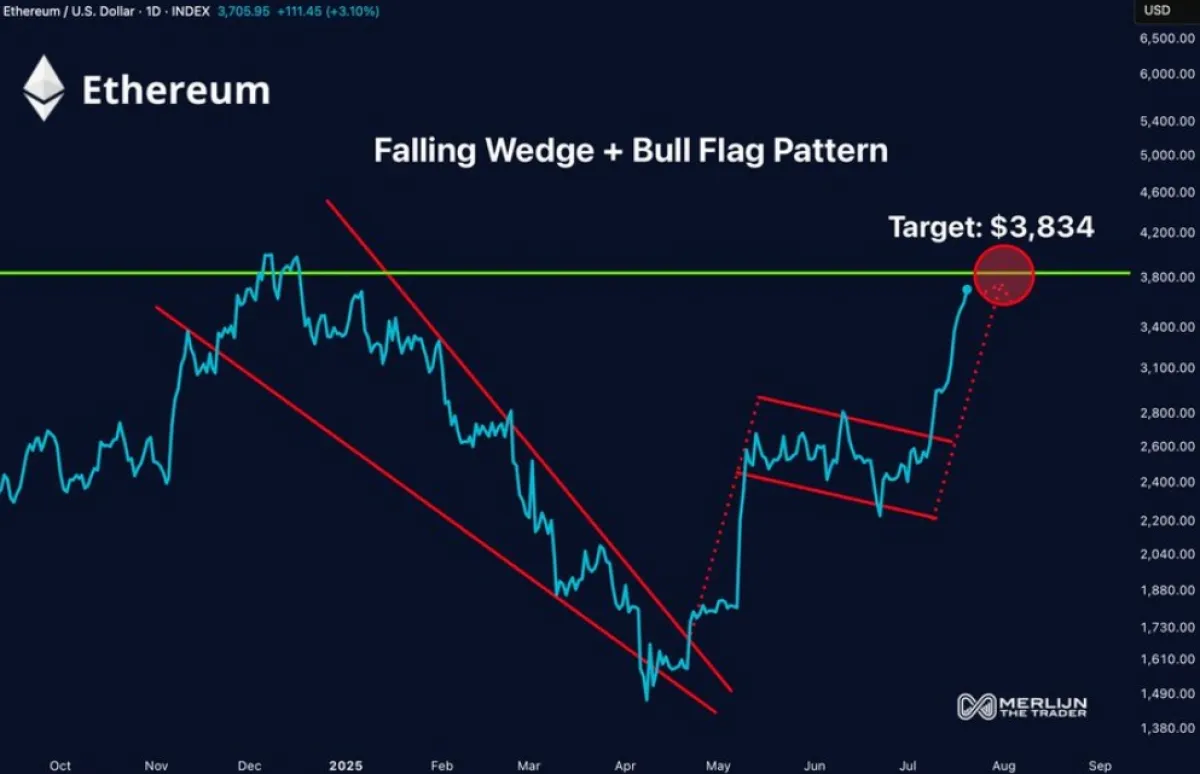

According to MerlijnTrader, Ethereum has confirmed a bullish breakout from two classical technical formations: a falling wedge and a bull flag. Both patterns are commonly associated with continued upward momentum.

The falling wedge, which had been forming for several months, broke to the upside in April 2025. Following that, Ethereum entered a bull flag pattern, consolidating just below $2,800 before surging above $3,700.

These breakouts support the current bullish momentum and suggest the market may soon test a key technical resistance level of $3,834.

MerlijnTrader stated, “Structure always wins. The setup is clean, and if momentum continues, ETH is on track to meet the $3,834 target.” Technical confirmation from multiple indicators reinforces this target, offering further confidence in near-term strength.

Altcoins Show Breakout Potential

Market analysts are starting to shift their attention towards altcoins, especially medium- and low-cap projects. According to Web3Niels, a market analyst, most of these altcoins are experiencing an outbreak after a long period of consolidation of up to seven months.

Volatility expansion commonly goes together with this phase of accumulation. Altcoins can mimic the trends of Ethereum and have even more sudden and rapid fluctuations as they attract capital.

The Web3Niels said, ETH is only the starting point. There are lots of breakout signs being given by alts. The rally could grow rapidly on all fronts in case ETH shows a further rise.”

During the rise in the market, the common tendency is a rotation of big-cap tokens into mid and small-cap ones, such as Ethereum. Once confidence in the market prevails, traders will tend to move towards altcoins with a better percentage gain.

Short Squeeze Likely at $4,000 ETH

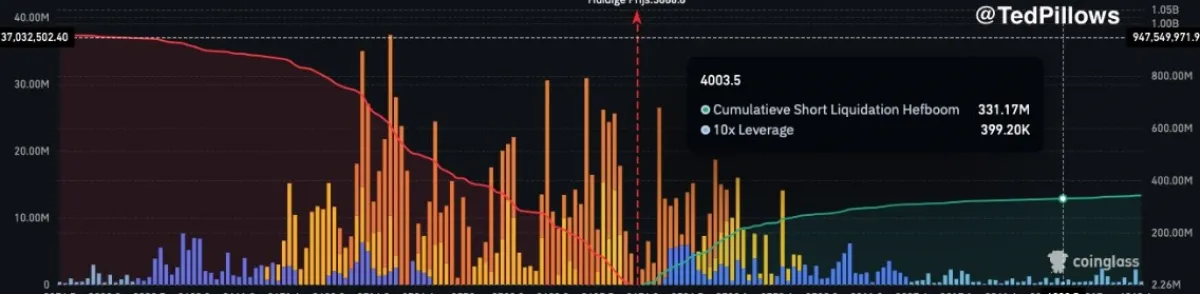

A separate dataset from Coinglass highlights the risk of a large-scale short squeeze as Ethereum nears $4,000. In the present situation, the total amount of short positions currently open to liquidity is $331 million and above.

A majority of these trades are being traded at 10x or even more, implying that the short side of the market looks mostly vulnerable.

Considering the fact that ETH is near to reach $4,000, short positions will encounter forced buy-back, applying extra buying pressure. The past records indicate that these conditions may speed up rallies within a short period.

There is a huge liquidation at short prices of between 3,600 and 4,000, which forms a narrow zone where the volatility can explode.

The green cumulative curve on the Coinglass chart that shows open interest is steadily increasing. This trend indicates rising long-side participation and the potential for continued upside momentum.