Dogwifhat (WIF), the popular Solana-based meme coin, has continued its bullish streak for the past three consecutive days. This upward rally in the meme coin has further strengthened following a shift in overall market sentiment, as the majority of assets turned green and recorded a notable price surge.

Current Price Momentum

At press time, WIF is trading near $0.65 and has recorded a price surge of over 18% in the past 24 hours. This bullish momentum in the meme coin and the entire shift in the market sentiment have garnered significant attention from traders and investors, leading to a surge in the trading volume. Data shows that WIF has recorded an 80% increase in its trading volume during the same period.

Dogwifhat (WIF) price action & Technical Analysis

Expert technical analysis suggests that WIF is turning bullish and poised for a massive upside rally. The four-hour chart shows that WIF has successfully broken out of a descending triangle pattern, paving the way for further upward movement.

Based on recent price action and historical patterns, if WIF’s price holds above the $0.60 level, there is a strong possibility that the meme coin could surge over 20%, potentially reaching the next resistance level at $0.783.

Besides price action, WIF’s Relative Strength Index (RSI) stands at 62, indicating strong momentum. Despite the notable surge in the meme coin’s price, this RSI level suggests that it still has room to continue its upward momentum before entering overbought territory.

Bullish On-chain Metric

With upside momentum building, trader interest in the meme coin has skyrocketed, as they increased their long-side bets and began opening new positions, according to on-chain analytics firm Coinglass.

Traders Strongly Believe in Long Positions

The Binance WIFUSDT Long/Short ratio currently stands at 2.34, indicating strong bullish sentiment among traders. This means that for every 2.34 long positions on WIF, there is only one short position.

Further data reveals that 70.10% of top traders are currently betting on the bullish side, while 29.90% are on the short side.

$3.71 million worth of bullish bets

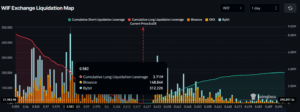

Meanwhile, liquidation data revealed that traders have targeted the $0.582 and $0.633 levels as key support and resistance zones and are over-leveraged at these levels.

Over the past 24 hours, they have built $3.71 million worth of long positions near the lower level and $394.17k worth of short positions near the upper level. These bets reflect a bullish market sentiment at the moment.