Key Insights:

- Dogecoin News gains traction as a ZK-proof proposal fuels a 700% jump in daily trading volume.

- Bitmine Immersion to raise $2.5B for a Dogecoin-focused treasury amid Layer-1 infrastructure advances.

- DOGE trades at $0.212 with renewed buying pressure, outperforming broader altcoin trends this week.

Dogecoin traded at $0.242 as of writing, posting a +13.86% weekly gain, outperforming many top altcoins. The daily trading volume surged past $2.86 billion, up 700% from last week’s average of $358 million. This spike coincided with the emergence of a zero-knowledge (ZK) proof proposal and corporate treasury action.

Market capitalization rose to $30.6 billion, placing DOGE at the 8 spot among cryptocurrencies by total valuation. Funding rates across major exchanges flipped positive, led by Binance and OKX, where DOGE perpetual swaps saw 2.4% funding rate spikes. Open interest also climbed 21%, reinforcing growing derivatives market activity.

The renewed trading momentum builds a technical support base near $0.196, which has held since late June. Dogecoin News coverage intensified following the ZK upgrade submission and treasury confirmation from Bitmine Immersion, sparking a wave of institutional analysis.

Also Read: Dogecoin Price Prediction: Will DOGE Rally to $1 in 2025?

Dogecoin News: ZK Proposal Signals Technical Leap for Dogecoin Core

A GitHub-based proposal introduced the potential for ZK-rollup integration into Dogecoin Core, aiming to enhance transaction scalability and privacy. Developers outlined a roadmap that includes verifiable computation and compressed data batching without compromising DOGE’s proof-of-work integrity. The community responded with growing validator engagement and node testing.

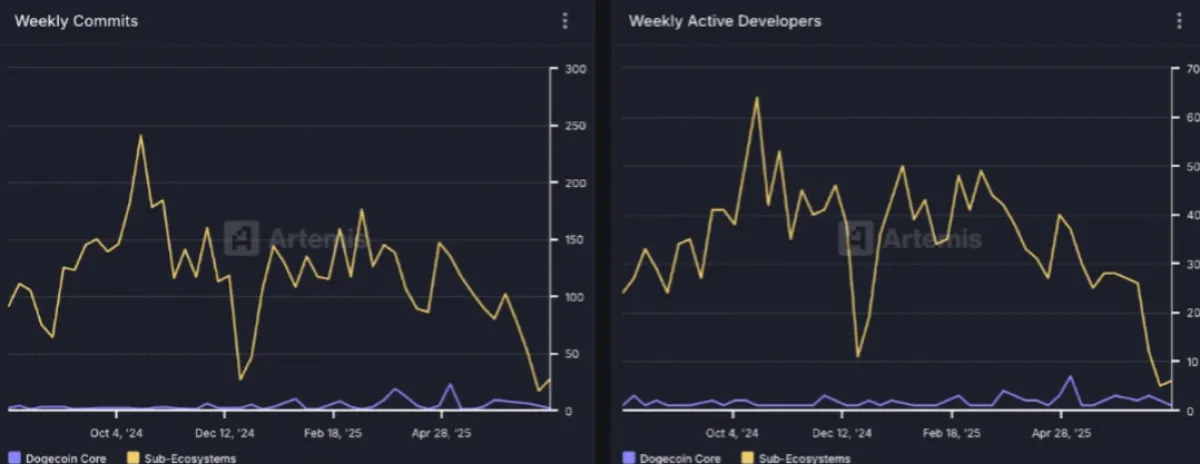

The suggested upgrade would enable Dogecoin to support increased transaction throughput and maybe basic smart contract capabilities. According to analysts following Dogecoin News, this functionality has the potential to open the door to Layer-2 adoption. The proposal is currently under review, but has already resulted in the rise of GitHub commits in the Core repository.

Technical sentiment as well became bullish, with stochastic RSI also indicating an upside at 63.28% and MACD expanding to the upside. Liquidity indicators reflect increased buy-side demand on DeFi pairs and centralized exchanges as developers refocus on them.

Bitmine Immersion Confirms $2.5B DOGE Treasury Initiative

Publicly traded Bitmine Immersion stated that it would raise 2.5 billion dollars to amass Dogecoin as a long-term corporate reserve.

It is one of the biggest DOGE treasury plans so far, with other companies, such as Quantum Solutions (Bitcoin) and Nature Miracle (XRP), having made similar crypto integration moves. The initial tranche of $400 million will be rolled out by the end of 2025, subject to approval.

Bitmine will focus on ensuring that DOGE is not only a treasury token but also an operational one on validator networks and internal payments.

DOGE custodianship will be managed through cold wallet infrastructure, and disclosures and audit-ready accounting will be made periodically. The company sees the decentralization of DOGE and its low fee system as a way to adopt treasury.

The new strategic direction is also associated with the overall transition of the firm to treasury structuring, which is digital-native. According to Dogecoin News, institutional investors are monitoring the schedule of allocation by Bitmine, and the market is likely to be affected in the coming months.

Funding Rates and On-Chain Metrics Support Bullish Outlook

DOGE funding rates across Binance, Bybit, and OKX rose sharply in the past 48 hours. Average rates climbed from near-neutral to +0.0122% hourly, while the leverage ratio hit 2.9x—the highest since April. Derivatives traders are positioning for a breakout above the $0.225 resistance level.

On-chain activity confirms momentum, with wallet activity rising to 1.13 million active addresses, up 14% week-over-week. Meanwhile, average transaction size jumped 31%, suggesting larger institutional flows entering the network. Liquidity on DOGE/USDT and DOGE/ETH pairs also tightened, reducing spread volatility across major venues.

The Dogecoin Core developers are still working to release updates linked to performance and storage efficiency. The ZK integration proposal would only speed up this trend and potentially put DOGE into a new category of usefulness.

Meanwhile, Dogecoin Core developers have become more active, making more than 32 commits and 4 new pull requests during this week. There has been increased community governance forum support for treasury-aligned DOGE utilities. Not only has momentum been driven by the speculation, but also by the fundamental infrastructure belief.