Dogecoin (DOGE), the world’s largest meme cryptocurrency, appears to be consolidating near the key resistance level of $0.25 after a 50% upside rally. This ongoing consolidation is attracting significant attention from traders and investors, as reported by on-chain analytics tools Coinglass and IntoTheBlock.

Whale Activity Soars 41%

According to data from IntoTheBlock, Dogecoin’s large transaction volume (typically linked to whale and institutional activity) surged by 41.12% over the past 24 hours. This sudden spike highlights rising interest and confidence in the meme coin, suggesting the potential for continued upside momentum.

With rising interest from whales and institutions, Dogecoin’s daily active addresses have also surged by 34.91% during the same period.

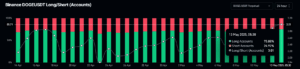

Traders Strong Bets on Long Positions

Not only that, traders’ bets on the bullish side have also skyrocketed, as revealed by Coinglass data. At press time, the Binance DOGEUSDT Long/Short ratio (the ratio that measures traders’ positions) stands at 3, indicating strong bullish sentiment. This suggests that for every three long positions, only one short position has been formed on Binance.

The data further reveals that 75.08% of DOGE traders on Binance hold long positions, while 24.92% hold short positions.

DOGE Price Momentum

Despite these bullish on-chain metrics, DOGE’s price seems to be struggling to gain momentum. At press time, the meme coin is trading near $0.2276 and has recorded a decline of 8.40% over the past 24 hours.

During the same period, its trading volume dropped by 10%, indicating lower participation from crypto enthusiasts compared to the previous day.

Dogecoin (DOGE) Price Action & Technical Analysis

According to expert technical analysis, DOGE’s price has been hovering near the key resistance level of $0.25 for the past three days. This ongoing consolidation raises the question of whether the meme coin will repeat history or if it’s just a normal correction. The last time DOGE reached this level, it faced notable selling pressure followed by further downside momentum.

Based on recent price action and historical patterns, if the meme coin’s consolidation continues and it falls to close a daily candle below the $0.22 level, there is a strong possibility that Dogecoin (DOGE) could experience downside momentum in the coming days.

On the other hand, if the ongoing sentiment shifts and DOGE breaches the resistance level by closing a daily candle above $0.255, it could open the path for an upside rally, with the meme coin potentially seeing a 20% gain toward its next resistance at $0.30.