DePIN Crypto Projects: In this rapidly evolving cryptocurrency landscape, investors, traders, and institutions are now looking toward the next bullish sector, which is going to be DePIN. DePIN, short for Decentralized Physical Infrastructure Networks, has been causing a stir in the cryptocurrency community.

These networks leverage blockchain technology and token rewards to develop tangible physical infrastructure such as roads, energy grids, and wireless networks. It is an innovative sector within the crypto realm that is continuously gaining traction.

In this article, we’ll get to know more about what DePIN crypto is, how DePIN works, top DePIN crypto projects, and many more things. So, read till the end for a complete and better understanding of DePIN and its crypto projects.

What is DePIN?

DePIN refers to Decentralized Physical Infrastructure. The name itself hints that the blockchain project that is being physically operated is either operating or going to operate in a decentralized manner on blockchain technology.

It is a concept where physical hardware infrastructure, like data storage systems, energy grids, wireless networks, and other physical systems, is operated in a decentralized manner with the help of blockchain technology. However, the participants in the DePIN crypto projects are rewarded or incentivized by the project’s token.

As of writing, the market cap of the DePIN industry is more than $25 billion, and it is continuously increasing. However, in April 2024, during a web3 festival in Hong Kong, the CEO of JDI Global CEO Wang Yiming, and the co-founder of UWEB, Romeo Wang predicted that the DePIN could hit a $3.5 trillion market cap by 2028.

Also Read: Top 5 DePIN Coins Set to Explode in 2025

How Does DePIN Work?

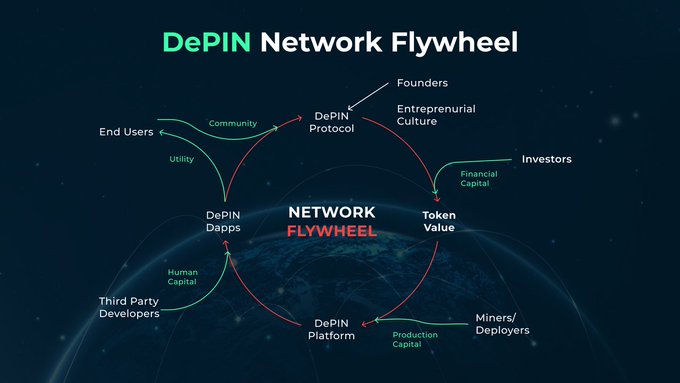

Decentralized Physical Infrastructure Networks (DePIN) are like a bridge between real places and the digital world of blockchain. It works by transforming all the physical operations into decentralized operations using blockchain technology.

Additionally, the participants in this project are also incentivized by the project’s token in the form of rewards. Here’s how it works:

Physical Infrastructure: This is physical stuff that is owned or had before joining the crypto project by companies, like sensors, routers, or solar panels.

Middleware: This is the connector between the physical stuff and the blockchain. It takes data from real-world places and sends it to the blockchain system. It’s like a messenger that makes sure information gets from one place to another.

Blockchain System: This is the brain behind DePIN. It acts like a manager that manages data from the middleware and handles payments. Additionally, it decides how to share resources among participants and calculates rewards for their contributions. These rewards are paid out in the form of cryptocurrencies of crypto projects like Helium (HNT), Filecoin (FIL), and others.

Is DePIN crypto a good investment in 2025?

In this evolving cryptocurrency landscape, DePIN crypto is one of the most promising sectors due to its rapid adoption and real-world use cases, making it a top choice for both investors and institutions.

Top 5 DePIN Crypto Projects to Watch

Here are five standout DePIN projects with the potential to 10x by 2025:

Helium (HNT): Helium creates a global network of internet hotspots using regular devices. By setting up a hotspot, participants earn helium (HNT) digital tokens for providing internet coverage, similar to sharing their Wi-Fi.

In the DePIN sectors, Helium (HNT) token is one of the best tokens on which crypto investors, as well as institutions, are making their bets. Besides all these things, the current market cap of the Helium crypto project is nearly $1 billion.

Filecoin (FIL): Filecoin offers decentralized cloud storage. Participant in this DePIN crypto project can rent out their extra storage space and earn Filecoin (FIL) tokens, while others pay for secure data storage on the platform. It is similar to renting a space for a certain period.

Filecoin is also one of the best tokens in the previous bull run FIL token made an all-time high of $186, and this time it may experience a similar move in the upcoming days. However, the current market of the Filecoin crypto project is nearly $5 billion, and it has the potential to 10x.

Render (RNDR): Render is a platform that allows users to contribute their unused GPU either from home or offices, and in return, they receive a Render (RNDR) token. However, this unused GPU helps to perform some heavy tasks like 3D animation, designing, as well as video editing.

The render crypto project is continuously gaining momentum following the praise and its CEO’s participation and stage sharing during an NVIDIA event. However, the current market cap of the RNDR tokens is nearly $5 billion, but it is one of the best DePIN crypto projects, which may be 10x in the coming days.

Akash Network (AKN): Akash acts as a mediator for cloud computing, connecting businesses needing extra computer power with those willing to rent it out. It is also another DePIN crypto project that helps people find who can rent their spare computer power, and the renters are rewarded with AKN tokens.

Theta Network (THETA): Theta Network is building a video streaming platform where viewers can improve streaming quality by sharing their internet connection. They earn THETA tokens as digital rewards.

These DePIN crypto projects offer opportunities to earn tokens by contributing to their respective networks, whether through providing internet coverage, storage space, computing power, or internet bandwidth. These tokens have the potential to surge massively in the coming days.

Why Is DePIN Crypto Important?

DePIN is important as it has the potential to revolutionize the Web3 landscape. Things like the transformation of physical infrastructure in a decentralized manner using blockchain technology not only create a transparent system but also make the infrastructure more secure and also also participants to earn DePIN crypto tokens.

However, these are some benefits of the DePIN crypto project:

Works Better: DePIN uses decentralized networks, which can work better than the old centralized ones we’re used to.

Saves Money: Without middlemen, DePIN can be cheaper for stuff like storing data or getting computer power.

More Accessible: DePIN can make things like the internet and energy available to more people all over the world.

Community Power: DePIN lets communities have a say in how their stuff gets managed. So, it’s like everyone pitches in to make decisions about what happens in their area.

Why DePIN Is the Future of Web3?

The Decentralized Physical Infrastructure (DePIN) crypto sector is one of the newest sectors in the realm of cryptocurrency and is gaining massive attention from crypto investors as well as institutional giants. Additionally, it has the potential to become one of the finest sectors of web3 technology.

Here, in this sector, the number of crypto projects is continuously rising and also gaining massive popularity. Following this, there is an expectation that DePIN will soon become an integral part of our daily lives.

Additionally, DePIN has the power to build a more open, efficient, and community-focused infrastructure, making it a space worth watching. But remember, since it’s still new, do your homework before diving into any DePIN projects.

This shift could lead to a more connected world with decentralized internet services, revolutionize transportation and logistics, empower sustainable energy solutions, enhance community control over infrastructure, and address security and privacy concerns.

Pros & Cons of DePIN

Pros:

Decentralization: DePINs operate on decentralized networks, which can enhance security, transparency, and resilience by distributing control and decision-making power among participants.

Efficiency: DePINs have the potential to streamline processes and reduce inefficiencies by eliminating intermediaries and automating tasks through smart contracts.

Incentivization: It rewards participants for contributing resources to the network.

Transparency: Utilizes blockchain technology to ensure transparent operations.

Cons:

Complex procedure: It is difficult to understand for newcomers.

Scalability: Challenges arise in maintaining efficiency and speed as the network expands.

Security Risks: Although blockchain technology provides robust security features, DePINs may still be susceptible to cyberattacks, hacking, and other security breaches.

Adoption Barriers: The adoption of DePINs may be hindered by technological barriers, lack of awareness, and resistance from entrenched interests in traditional infrastructure systems.

Conclusion

DePIN is a big idea that could change a lot of things in the future. As we continue to explore and develop this emerging technology, and since it is new, it’s essential to remain vigilant, conduct thorough research, and foster collaboration to maximize the benefits and mitigate the risks associated with DePINs.

With careful consideration and strategic planning, DePINs have the potential to shape a future that is more connected, sustainable, and resilient for generations to come.