Chainlink (LINK) has been making steady progress in recent weeks, signaling a bullish Chainlink price prediction. After experiencing a series of price fluctuations, LINK is now facing critical resistance levels. With the market showing growing interest, LINK’s price is poised to break out above the $20 mark.

This level is seen as pivotal for further gains, as LINK’s performance could influence broader market sentiment.

Market Sentiment and Leverage Driving Chainlink’s Upward Trend

Chainlink’s price has been rising steadily, currently trading at $15.31, a 6.46% increase in the last 24 hours. The price recently moved up from $14.36, reaching a new peak. However, the key resistance level remains around $16.00, which has proven difficult for LINK to break through in the past. This level is crucial in determining whether the price can move further into higher territory, with $20 being the next target.

The growing market interest is reflected in a significant surge in trading volume, up 77.61% to $550.5 million. Increased volume suggests heightened participation, potentially driving further price growth. Alongside this, open interest has risen, signaling more traders are taking bullish positions on Chainlink.

Market sentiment remains positive, especially on platforms like Binance, where many traders are betting on LINK’s price to break through the $16 resistance. While the market is showing strong upward momentum, caution is advised due to potential volatility, especially if leveraged positions face liquidation.

Also Read: Dogecoin Prediction: Why Experts Believe DOGE Could Explode Soon

Chainlink Price Prediction: Derivatives Data Analysis Shows Rising Interest

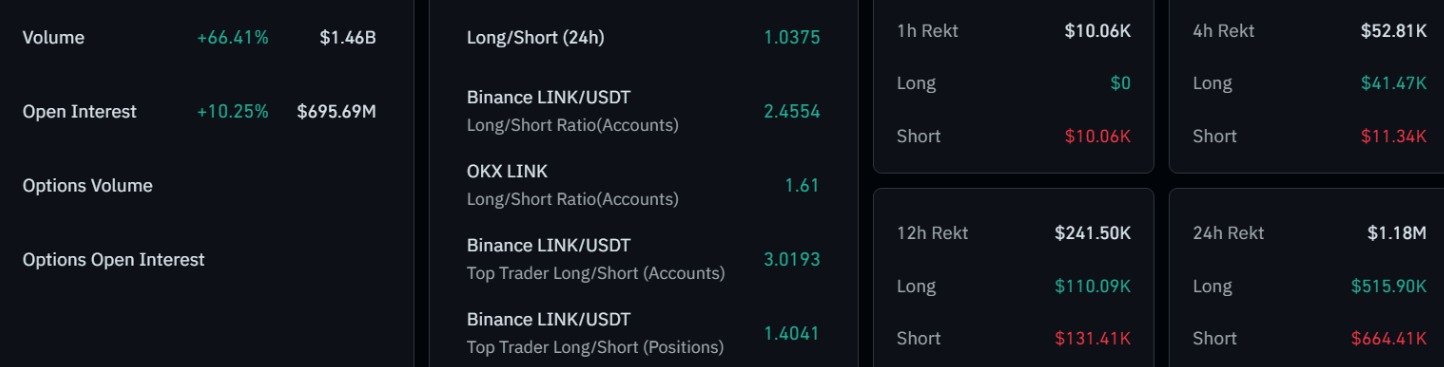

The derivatives market for Chainlink shows significant activity, highlighting an increasing interest from traders. The open interest in LINK futures has grown by 10.25%, standing at $695.69 million. This increase indicates that traders are taking on larger positions, betting on LINK’s price direction. The volume for LINK options also reflects a rising engagement, though no specific figures are provided.

In terms of long and short positions, the long/short ratio suggests a balanced but slightly bullish market. On Binance, the LINK/USDT long/short ratio is 2.45, meaning there are more long positions than short ones.

his shows a generally optimistic outlook among traders for LINK’s future performance. However, on platforms like OKX, the sentiment is more neutral, with a 1.61 ratio indicating a moderate level of bullishness.

Source: CoinGlass

The market also shows signs of potential short squeezes, with short liquidations outweighing long liquidations in recent hours. The total liquidation figure of $1.18 million over the past 24 hours highlights the potential risks in the current market. Liquidations in both long and short positions are notable, as they can result in sharp price movements. This risk makes it important for traders to stay alert to shifts in market sentiment.

Also Read:

Technical Indicators Suggest Potential for a Breakout

Chainlink (LINK) is changing hands at $15.303, representing a minor gain of +0.04% in the last 24 hours. The market has been unable to decide on the price as it has been range-bound between $15.00 and $16.00.

However, the bullish trend that has been formed lately after touching a low of $14.00 indicates a possible bullish reversal. The market is still hesitant, although the sentiment is bullish and traders are eyeing significant levels to explode higher.

The MACD indicator depicts a minor positive momentum, as the MACD line is at 0.135, above the signal line (0.270). The histogram is in retreat, but it is still positive, which reflects buying pressure. The Awesome Oscillator, at the same time, is also bullish with a current value of +1.263, which indicates a very strong market momentum.

Moreover, both signs provide evidence that the existing purchasing power may be subsiding, and it is essential to exceed $16.00 to ensure that the additional bullish momentum is present.

The important support is still at $14.00 to $14.50, and the resistance is at $16.00. Provided that LINK manages to break above $16.00, the rise towards $17.00 or even more becomes possible. A failure to achieve this, however, might result in a pullback to support levels, more so when the momentum falters.