With an 8% upside momentum, the Chainlink price has recorded a 41% price increase with five consecutive green candles. This bullish move has shifted market sentiment to positive, leading to a resistance breakout and triggering increased participation from the bulls.

Chainlink Price and Rising Trading Volume

Chainlink price has surged over 8% and is currently trading at $22.40. With this surge, the asset has entered the top gainer list, outperforming major assets like Bitcoin (BTC), Ethereum (ETH), and many others.

This impressive performance over the past 24 hours has attracted massive participation from investors and traders, resulting in a 15% increase in trading volume compared to the previous day.

Given the current market sentiment, a well-followed crypto expert posted on X (formerly Twitter) that LINK has begun its upward momentum following the launch of the Treasury Strategy.

Recently, due to tariffs and a market correction, Chainlink’s price fell significantly but managed to hold the $15 level and has now reached a new 7-month high. The expert added, “Great times are ahead of us.”

On-Chain Metrics Hints at Bullish Traders’ and Investors’ Interest

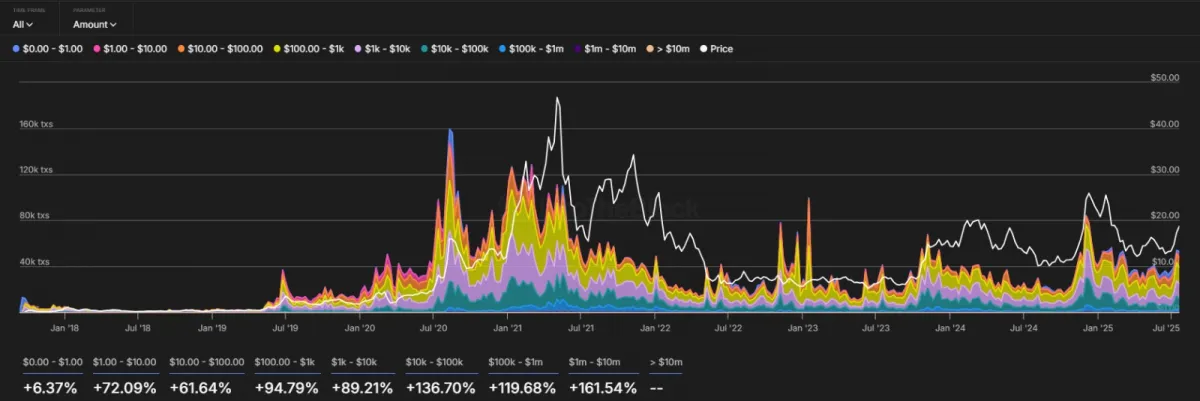

Recently, data from the on-chain analytics tool IntoTheBlock reveals that the transactions ranging between $1 million and $10 million, which are typically linked with the whales, have surged by 161.57% over the past 24 hours.

Not just that, investors and long-term holders have also been spotted showing strong interest in the token.

Data from the on-chain analytics tool Coinglass reveals that $4.21 million worth of LINK tokens have been found leaving the cryptocurrency exchanges. While the quantity may be relatively small but it shows the growing interest in the asset as prices continue to surge.

In addition, traders also see following the same trend. Data shows that $20.94 and $22.32 are the major liquidation levels where traders are over-leveraged.

At these levels, traders have built $$16.36 million worth of long positions and $9.35 million worth of short positions. This has made it clear that bulls are dominating and appear to be pushing LINK price to continue its upside momentum.

Chainlink (LINK) Price Action and Technical Analysis

According to expert technical analysis, the Chainlink price has successfully broken out of a local resistance of $21.65 and has appeared to closing above it. This breakout, along with a potential candle close above the key level, could open the path for significant upside momentum.

Based on recent price action, if Chainlink price closes above the $22.40 level, it could experience another 25% price increase, potentially reaching $27.20. However, as the price continues to rise, there is also a possibility of a correction before the upward momentum resumes.

At press time, the Supertrend indicator has turned green and is positioned below the Chainlink price, indicating that the asset is in an uptrend. This suggests that bulls are dominating the market, supported by strong buying pressure.

Meanwhile, the Relative Strength Index (RSI) stands at 73, indicating that the asset has entered overbought territory and that there is a strong possibility of a price correction before it continues its upward momentum.

Also Read: Solana Price Breaks $175 Resistance, Eyes Next Move to $187