Despite ongoing geopolitical tensions between Israel and Iran, Bitcoin Cash (BCH) remains optimistic and is garnering attention from crypto enthusiasts with its impressive performance. The daily chart reveals that the asset has gained a notable 20% in recent days, prompting analysts and experts to make bold predictions.

Analysts’ Bold Predictions for Bitcoin Cash (BCH)

Given the current market sentiment, several bold predictions have surfaced on X (formerly Twitter). On June 16, 2025, a well-followed crypto analyst noted, “The price could still be working its way to new highs, and the $903–$915 area seems like an ideal target.”

Meanwhile, another analyst made a bold prediction, setting upside targets for Bitcoin Cash (BCH) at $625, $1,245, and $1,830 — as long as the price holds above the key $380–$400 support area.

In the post, the expert stated, “Bitcoin Cash is breaking out from a multi-month accumulation zone, forming a rounded bottom, and showing strong weekly bullish momentum.”

These are not the only predictions experts and analysts have made about BCH, but they highlight the rising interest and confidence in the asset despite ongoing geopolitical tensions.

Also Read: Cardano News: New Reward Token $NIGHT Could Shift Staking Game

On-chain Metrics Signal Mixed Sentiment

However, retailers and long-term holders see the recent surge as a perfect time to capitalize, as they were found dumping their BCH holdings, according to the on-chain analytics firm Coinglass.

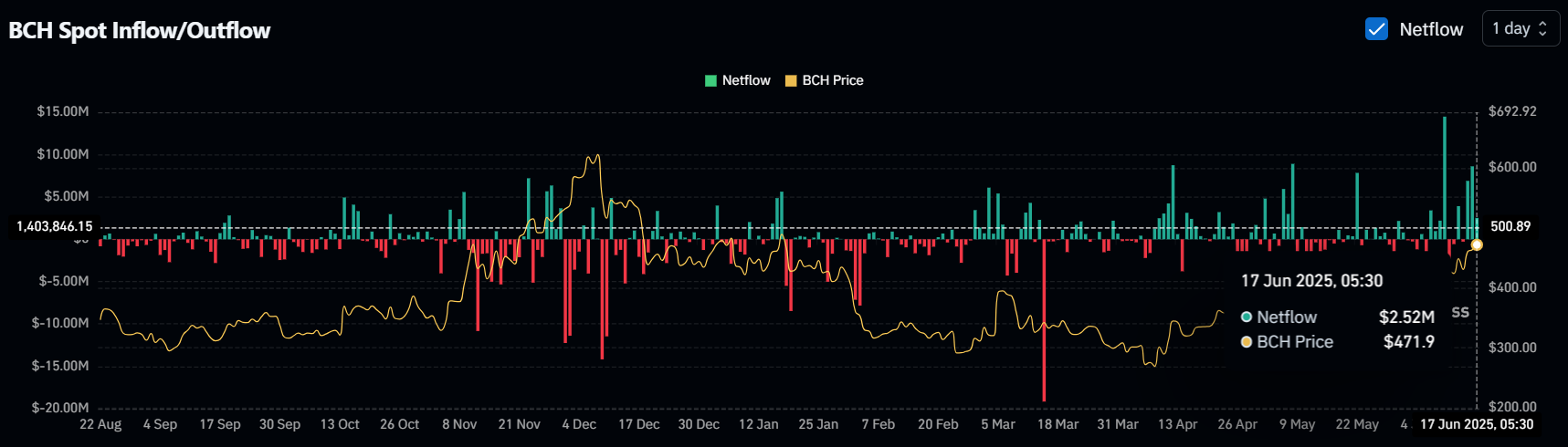

Data from the spot inflow/outflow reveals that exchanges across the crypto landscape have recorded an inflow of $2.52 million worth of BCH in the past 24 hours.

This notable inflow, given the current market structure, indicates potential dumping by BCH holders and could halt the upside momentum.

Major Liquidation Levels

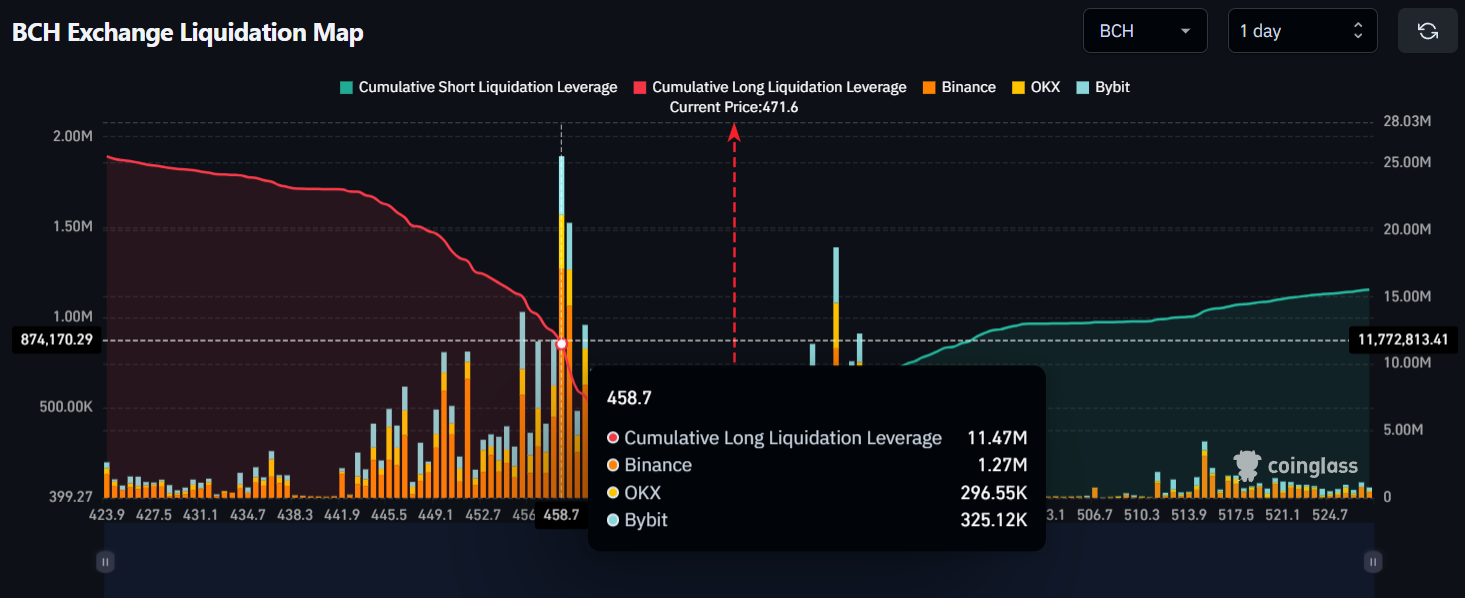

Meanwhile, intraday traders have been found betting alongside the BCH move, as the number of long positions is more than double that of short positions.

Data shows that traders are currently over-leveraged at $458.7 on the lower side (support) and $486.9 on the upper side (resistance).

At these levels, traders have built $11.47 million worth of long positions and $5.34 million worth of short positions, indicating that bulls are currently dominating, which appears to support BCH in continuing its upside momentum.

Current Market Sentiment

At press time, BCH is trading near $471 and has experienced a price surge of over 4.21% in the past 24 hours. During the same period, its trading volume soared by 15%, indicating heightened participation from traders and investors compared to the previous day.

Bitcoin Cash (BCH) Price Action and Key Technical Levels

According to CryptoTimeNow’s technical analysis, BCH appears bullish, and with the recent rally, it has now reached its key resistance level of $485. This level has a strong history of price reversals.

The daily chart shows that whenever the asset’s price reaches this level, it faces massive selling pressure, resulting in downside momentum.

Based on the recent price action, if the current momentum remains unchanged and the BCH price successfully breaches the resistance level, there is a strong possibility that it could soar by 30% and reach the $632 level in the future.

On the other hand, if sentiment shifts and selling pressure reappears, history may repeat itself, and the price could experience downside momentum in the coming days.