Binance Coin (BNB) price came into focus after recent technical developments and derivatives data hinted at a potential explosion to the $700 level. Consequently, traders and analysts were looking forward to confirmation of this momentum shift.

Binance Coin Price Breaks Bullish Pattern, Targets $700

Market analyst AGENT 47 recently shared a technical analysis that indicated that the Binance Coin price has broken out of a clear bullish formation in the daily chart. The pattern breakout indicated a reversal of the consolidation situation, and this gave a potential possibility of moving higher.

Notably, the price was stabilizing above the $630–$640 region, which was expected to act as short-term support. This zone also aligned with the previous resistance and turned to support, validating the breakout structure.

Based on the chart provided by AGENT 47, the breakout had an estimated target of approximately $700. Measured move calculations based on the prior range were taken into account in the analysis and supported the determination of the next area of interest at the level of $700 as logical.

Consequently, if the price holds above the $630–$640 region in the coming days, it may confirm bullish strength in the current move.

Volume and Open Interest Surge With Renewed Participation

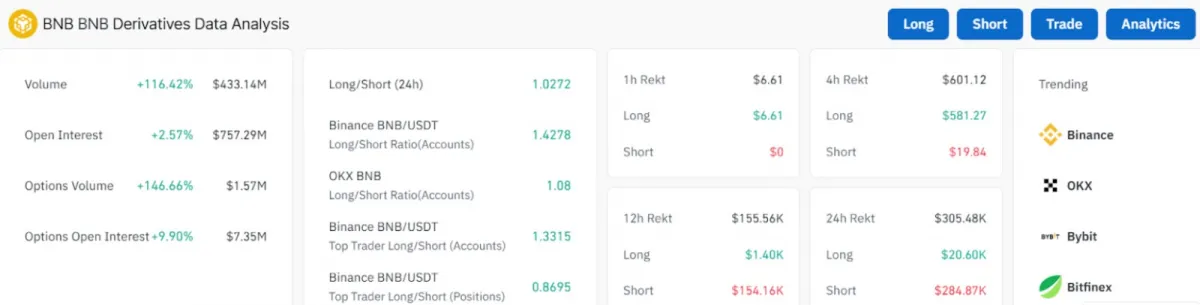

Meanwhile, the Binance Coin derivatives market has recorded a steep rise in trading volume, indicating rising engagement in the market. In the last 24 hours, BNB trading volume has increased by 116%, to 433.14 million. This peak signified the aggressive positioning of players in the market, which tends to mirror trend stretching or expectation of significant Binance Coin price action.

Furthermore, the open interest also increased by 2.57%, to 757.29 million. This indicator monitors the overall volume of pending derivatives contracts and indicates their long-term participation, not speculation. This rise in volume and open interest showed a dedication to directional exposure in BNB by traders.

Additionally, there was further activity in options markets. Options volume rose by 146% and open interest by 9.9%, indicating either hedging or positioning around anticipated volatility.

Moreover, the Bullish sentiments are also strengthened by short liquidations. In the past 24 hours, 284.87K short positions had been liquidated, with less than 20k options liquidated in the long component. This imbalance means that the bears were forced to lose their positions as the Binance Coin price shifted against them, pushing it up.

Also Read: New Tariffs Incoming? Trump’s Trade Tsunami

BNB Funding Rate Turns Positive

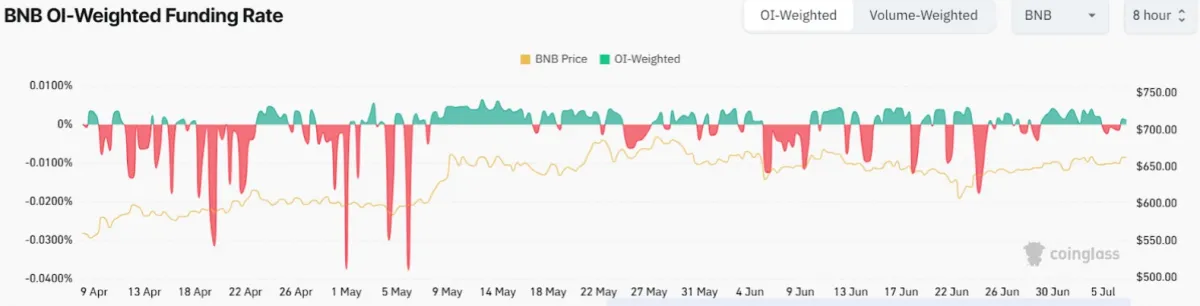

More so, alongside the technical breakout and rising trading activity, BNB’s funding rate flipped positive in early July. Notably, the OI-weighted funding rate is the cost of sustaining either a leveraged long or a leveraged short.

A persistent high rate shows that traders are paying a premium to have long positions, a sign of a bullish bias in market sentiment.

Besides, this occurred in tandem with rebounds in Binance Coin price dynamics. Traditionally, prolonged instances of positive funding have been associated with upward price action because buyers are in control of the momentum.

Meanwhile, recent analysis showed Binance Coin price trading near $650, holding above key support around $625 amid a forming bullish pennant. Even though the MACD and Awesome Oscillator have not shown strong momentum signals, a breakout can occur based on the structure.

An upside break above $660 could signal a bullish continuation, but a decline below $625 may turn bearish. Network growth and rising open interest further supported a cautiously bullish outlook.

As of the time of writing, Binance Coin price stood at $662, gaining 1.1%. The trading volume increased by 27.8% to 1.5B. With a bullish momentum, BNB had traded just below key resistance at $664, while support held at $654.