The Binance Coin price has entered a strong bull run this month, reaching its highest level since 2025. BNB token peaked at $780 on Monday, a big jump from the year-to-date low of $503. This article explains why the Binance Coin token is in a bull run and what to expect.

Binance Coin Price is Surging as Altcoins Roar Back

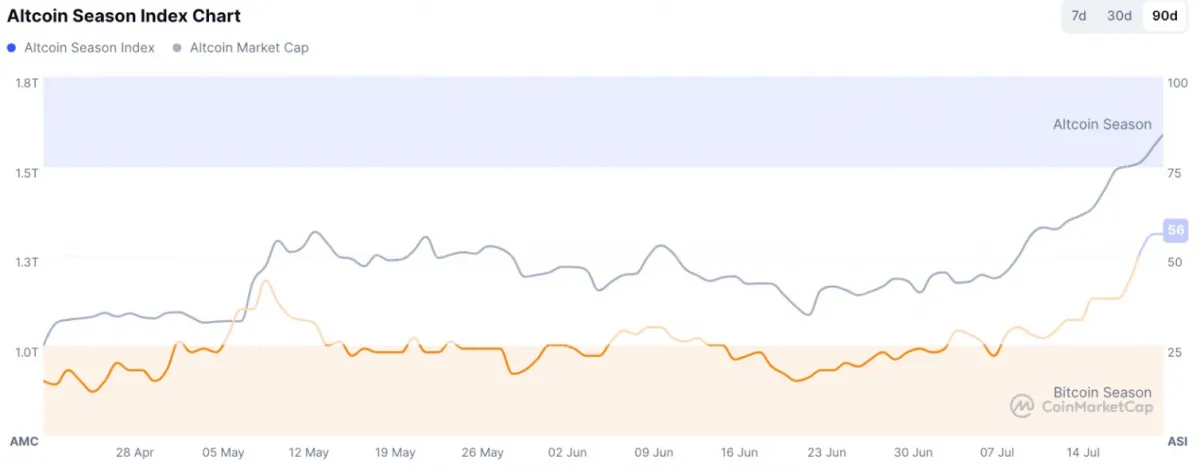

The BNB price has moved into a strong bull run this month as altcoins soared. Indeed, as the chart below shows, the altcoin season index has jumped to 56, the highest point in months. Tokens like Pudgy Penguins, SPX6500, and Virtuals Protocol led this surge.

The altcoin season index ignited last week when Bitcoin price surged to the highest level on record of $123,300. Historically, a Bitcoin surge normally leads to more upside among altcoins, including the BNB token.

The same happens when there is a sense of greed and fear of missing out (FOMO) among investors. Data shows that the fear and greed index has surged to 67, meaning that it may get to the extreme greed zone of 70.

BSC Ecosystem is Thriving

The Binance Coin price has jumped because of the ongoing jump in the BNB Smart Chain (BSC) ecosystem. DeFi Llama data shows that its decentralized finance ecosystem has over 908 applications with over $10 billion in total value locked (TVL) and $19 billion in bridged TVL.

The data show that the network has become the biggest player in the decentralized exchange (DEX). PancakeSwap, the biggest DEX protocol in the ecosystem, handled over $183 billion in the last 30 days and $44.7 billion in the last seven.

Uniswap, which was the biggest DEX protocol for a long time, handled over $84 billion in tokens in the last 30 days. PancakeSwap is now handling more volume than other DEX protocols like Raydium, Orca, Aerodrome, and Fluid, combined.

More data shows that the BSC Chain is the second most active one after Solana. It had over 33 million active addresses in the last 30 days, a 47% monthly increase.

At the same time, the number of transitions slipped to 392 million, while the network fees stood at $10 million. BSC’s fees are normally lower than other chains because it prides itself on having low transaction costs.

Also Read: XLM Crypto Price Prediction: Can Stellar Hit $1 After Its Recent Surge?

BNB Price Has Strong Technicals

The BNB price has jumped because of its strong technicals. The weekly chart shows that the coin has formed a cup-and-handle pattern, a popular continuation sign.

This pattern comprises a horizontal support at $665 and a rounded bottom, whose lower side is at $186. It has been forming the handle section of this pattern since March this year.

The profit target in a C&H pattern is established by measuring the distance from the cup’s upper side to its lower side. In this case, this distance is about 74% in percentage terms.

Therefore, measuring the same distance from the cup’s upper side gives the target price at $1,137. This means that the token has a 50% upside from the current level.

A surge to $1,137 will be confirmed if the coin jumps above the important psychological point at $100.

Final Thought

The Binance Coin price has been in a slow bull run in the past few weeks. This surge has coincided with the ongoing recovery of Bitcoin and the potential start of the altcoin season.

It also happened as data showed that the BSC’s network is gaining steam, especially in decentralized finance, stablecoin processing, gaming, and other fields.

This growth could continue in the coming months as more developers move to the network after the recent Pascal, Lorentz, and Maxwell, which have made it one of the fastest networks