Avalanche’s native token AVAX price is poised for a downside momentum, as both whale activity and recent price action flash a red flag. The daily chart reveals that since the beginning of May 2025, the asset has been in a downtrend, consistently forming lower highs and lower lows.

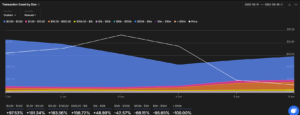

Whale Transactions Dip Sharply

Amid this, large holders and investors were hesitant to participate. Data from the on-chain analytics platform IntoTheBlock reveals that transactions by whales worth $100K to $1 million, $1 million to $10 million, and over $10 million have dropped by 65%, 95%, and 100%, respectively.

This notable drop in whale transactions indicates weakening confidence and interest in AVAX, which appears to be a major red flag for the token and could trigger further downside pressure in the coming days.

Also Read: TRUMP Coin Price Could Soar by 41%, Here’s Why

Long Liquidations Rise, Is a Crash Incoming?

Due to this price decline, traders who had been betting on long positions ended up facing liquidations. Over the past 24 hours, the majority of trader liquidations have come from long positions.

According to Coinglass, a total of $290K worth of long and short positions have been liquidated, with the majority, $189K, coming from the long side. This highlights the market’s bearish structure and suggests that sellers are currently in control.

When combining all these on-chain metrics with the current market sentiment, it appears that AVAX is bearish and may see downside momentum in the coming days.

Price Momentum Weakens, Volume Drops

As of now, AVAX is trading near $20.30 and has recorded a price decline of over 3.10% in the past 24 hours. This decline may be a potential reason behind the notable drop in the asset’s trading volume.

According to CoinMarketCap data, during the same period, AVAX’s trading volume has dropped by 22% compared to the previous day.

Avalanche (AVAX) Price Action and Key Levels

According to Cryptotimenow, AVAX price is near a make-or-break situation, but based on the current sentiment and whales’ activity, it appears bearish.

The daily chart reveals that AVAX price has been making lower highs and lower lows, and the asset is near a descending trendline that has consistently acted as resistance.

AVAX Price Prediction

Based on recent price action, if history repeats and AVAX fails to breach the descending trendline, there is a strong possibility that the asset could see a price decline of 20% until it reaches the $16 level.

On the other hand, if the sentiment shifts and the price breaks the trendline and closes a daily candle above $21.50, AVAX could see 20% upside momentum.