Altseason: A sharp shift is unfolding in the crypto market, marked by reduced Bitcoin dominance and rising interest in altcoins.

Recent activity suggested the start of an altseason and that traders and investors are reallocating capital into Ethereum and alternative assets as new cycle patterns emerge.

Bitcoin Dominance Declines, Signaling Altseason Potential

Notably, Bitcoin dominance has declined back into the sub 64% range, the lowest level in recent months. According to data shared by AshCrypto, the percentage share of Bitcoin in the total crypto market capitalization plummeted following multiple consecutive 4-hour red candles.

Consequently, speculation about the onset of an altseason and fund rotation out of Bitcoin into other digital assets has ensued due to the selloff. Moreover, this decline occurred against a generally stable Bitcoin price, indicating that the shift is not related to a fall in the BTC but due to increases in values and trading volumes of altcoins.

Historically, this kind of losing dominance has been followed by a new altseason, in which altcoins surge ahead of Bitcoin in a specified period. Ethereum, specifically, has demonstrated restored activity as investors and traders position in assets with a greater degree of short-term growth.

Also Read: Emirates to Accept Crypto Payment with Crypto.com

Investors Rotate Capital Into ETH and Altcoins

More so, Real-time market activity indicated a noticeable shift in risk appetite. As Bitcoin dominance dropped, Ethereum gained both volume and price momentum, leading to the interpretation as the early stage of a sustained altseason.

In addition, altcoins trading volume was also up with those tied to Layer-2 platforms, real-world assets (RWA), and artificial intelligence tokens trading the best. These rotations showed that traders are less likely to trade based on Bitcoin exposure and are more willing to diversify amongst altcoins.

Furthermore, an increasing open interest in the altcoin perpetual futures contract showed that there was rising leveraged exposure on the non-Bitcoin asset.

Whale Activity Suggests a Broader Altcoin Super Cycle

According to WhaleGuru, broader conditions may support the emergence of a new crypto super cycle. According to the analyst, liquidity has been coming back into the digital asset market, but it may have been encouraged by macroeconomic trends like policy easing and easy markets. Combined with diminished BTC dominance, these signals have caused speculation that altseason could start in the current month.

This view was echoed by other large account holders and trading groups who are tracking fund flows and wallet activity. Increased volume in ETH, Solana, and several DeFi-linked tokens suggested that institutional and retail investors alike are adjusting their positions.

In previous cycles, such liquidity increases were also accompanied by intense alt rally periods. Should the trend persist, it may signal the start of a wider capital drift out of Bitcoin.

Altcoin-to-BTC Ratio Nears Historical Breakout Zone

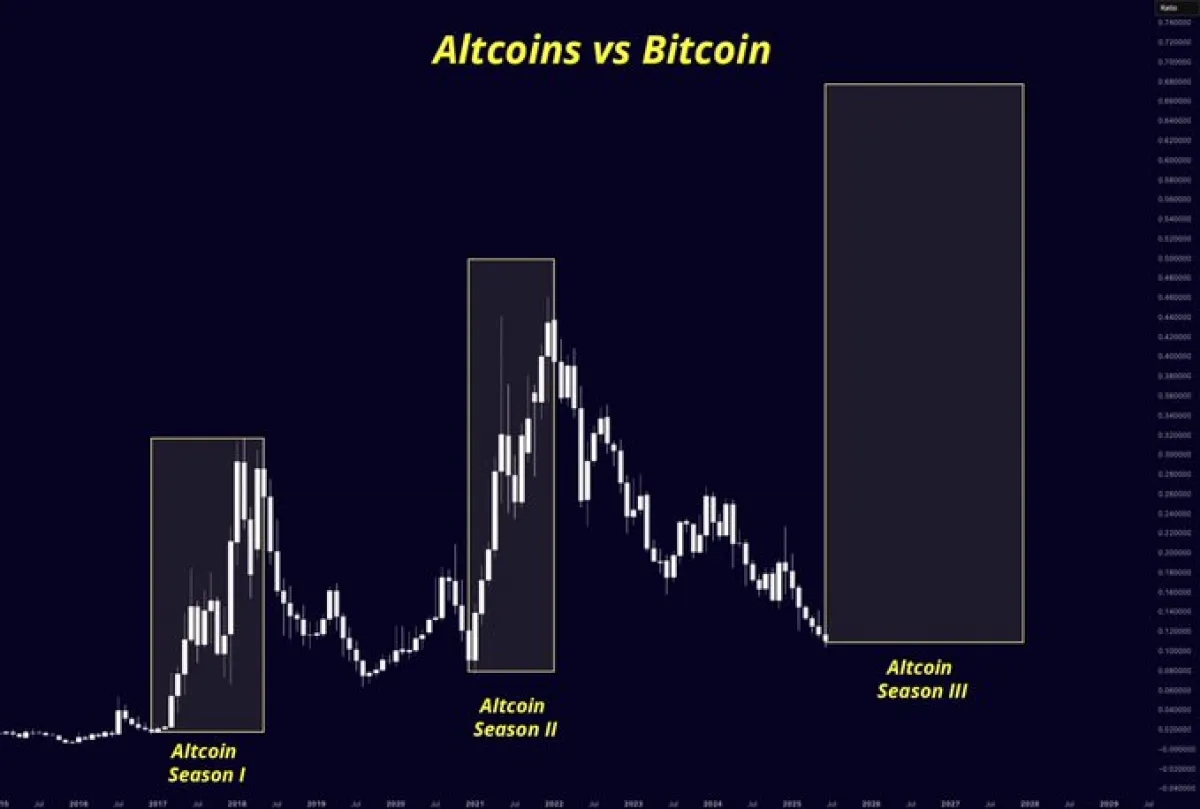

Moreover, a chart shared by Mister Crypto showed the altcoin-to-Bitcoin ratio sitting near historical support. This level has previously served as the base for prior altseason cycles in 2017–2018 and again in 2021.

In both cases, altcoins staged strong rallies after reaching similar ratio thresholds. The chart outlined three distinct zones: Altseason I, Altseason II, and a projected Altseason III.

Subsequently, the current position on the chart suggested the market could be repeating that pattern. The structure indicated a multi-year decline trend that was supported in the same area that resulted in the earlier breakouts.

Assuming the altcoin cycle repeats historical patterns, the altcoin/BTC ratio can continue to rise in the months ahead, as investment turns and risk appetite grows.