Ripple has grown its partnership with the Spanish banking group, BBVA, to provide trustworthy digital asset custody technology. This collaboration occurred at a time when BBVA introduced its new crypto-asset trading and holding service of Bitcoin and Ether in Spain.

The decision coincided with Ripple’s efforts to enable the European adoption of digital assets. Moreover, XRP price recorded a significant surge and broke through major resistance at $3.

Ripple Partners with BBVA for Digital Asset Custody Technology

Ripple’s collaboration with BBVA is a major move towards the increased usage of digital asset service providers by financial institutions across Europe. Ripple news indicated that the XRP company will supply BBVA with a self-custody system that will handle digital assets.

More so, the technology will be incorporated in BBVA’s new crypto-asset trading and custody solution, which already supports Bitcoin and Ether. The retail customer will experience a secure, compliant, and scalable manner of keeping and exchanging crypto.

Cassie Craddock, the Managing Director at Ripple, stressed that transparent rules were crucial in the recent development. Cassie Craddock commented,

“Now that the EU’s Markets in Crypto-Assets regulation (MiCA) is established across Europe, the region’s banks are emboldened to launch the digital asset offerings that their customers are asking for.”

The Head of Digital Assets at BBVA, Francisco Maroto, stressed that this bank is actively working on being a leader in digital innovation. BBVA intends to offer a safe environment to its customers in navigating the crypto-asset sector through Ripple technology.

It is important to note that the bank already introduced crypto-asset products in Switzerland and Turkey. This recent move to Spain demonstrates that BBVA is still determined to adopt blockchain technology.

XRP Price Breaks Through $3 Resistance Level

At the same time, XRP price conquered its $3 resistance point, strengthening analysts’ positive expectations. The token price rallied following a period of consolidation below this critical resistance level.

Analyst DarkDefender observed that the subsequent levels of resistance are between $3.07 and $3.13.

Nevertheless, he noted that any failure to breach the $3.13 level would spur a reversal to lower Fibonacci levels and might cause the XRP price to revert to the $2.70 band.

XRP price increase above $3 restored confidence among traders and investors. The rally highlighted Ripple’s strengthened position in regulatory efforts and its growing partnerships with major financial institutions.

Path Ahead for Ripple Price

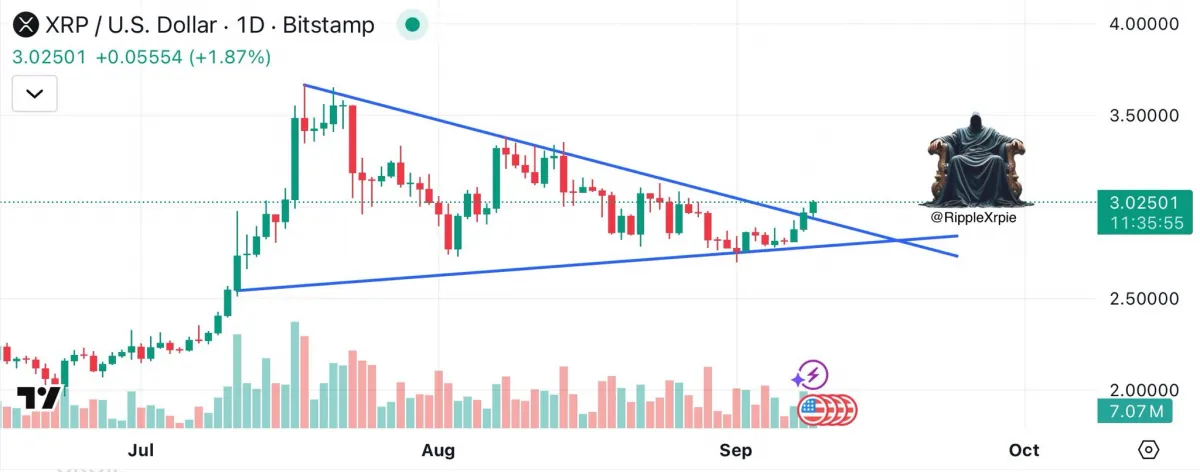

Analyst JackTheRippler also commented on the Ripple price technical structure. The analyst reported that XRP crypto emerged out of a converging triangle pattern on the daily chart, which means that it has a high possibility of rising further.

The breakout, during which the XRP price rose by more than 2%, was also followed by a rise in trading volume. This increase indicated a surge in the level of participation in the market, which also makes the sustainability of a bullish rally.

According to JackTheRippler, the escape of the triangle pattern caused an instant price increase as well. XRP price is currently trading over major resistance points. The top altcoin price is likely to keep its upward trend to higher price levels, and the key resistance points were set at $4.00 and $5.

Should XRP price maintain its bullish trend, analysts believe the crypto may rise to between $8 and $10 in the future.

The collaboration between Ripple and BBVA also enhances the XRP crypto presence in the market. With additional banks adopting the Ripple technology, the XRP token can enjoy more usage and adoption in real-life applications.