It has been a week since the XRP price appeared to be struggling at a local resistance level of $3.30. As of today, August 14, 2025, despite breaking out of this hurdle, the asset has once again failed to sustain above that level and repeat its historical momentum.

Whales Add 320 Million XRP Tokens, Time to Buy?

Amid this uncertainty, crypto whales have shown strong interest and confidence in the asset, as revealed by a prominent crypto expert on X.

In a post, the expert shared Santiment data showing that whales accumulated a significant 320 million XRP tokens over the past 72 hours. This substantial purchase suggests a potential parabolic move, or that whales believe XRP holds strong upside potential.

This post on X gained widespread attention from the crypto community and raises the question of whether this is an ideal buying opportunity or not.

You might be wondering at what level these whales purchased such a huge amount of XRP. According to CoinMarketCap data, XRP’s price has remained sideways over the past week, trading between $3.10 and $3.32.

XRP Price and $36.32 Million of Outflow

At press, the XRP price stands at $3.23 and has slipped over 1.30% in the past 24 hours. Despite a price decline, investors and traders’ participation continues to grow; data shows that the asset’s trading volume during the same period has surged by 14%.

This suggests rising interest in the token, which was potentially triggered by the recent breakout and strong interest in XRP.

Meanwhile, this strong interest was recorded on-chain analytics tool Coinglass. Data from spot inflow/outflow shows that over $36.32 million worth of XRP tokens have moved out of exchanges over the past 48 hours.

This outflow suggests ongoing accumulation by investors and long-term holders, which is considered a bullish sign for XRP.

Traders’ Major Liquidation Levels

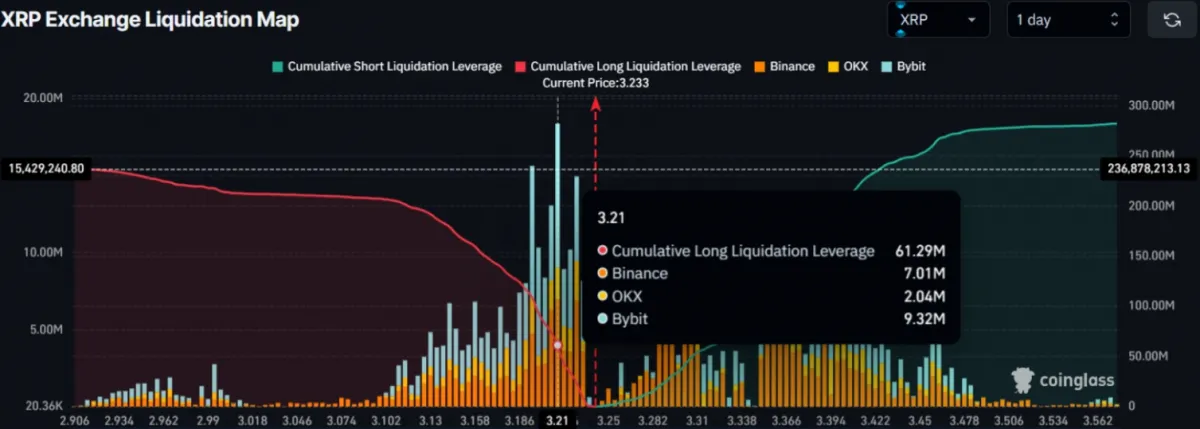

On the other hand, traders seem to be following a bearish outlook. At press time, XRP’s major liquidation level on the downside is at $3.21, which is on the verge of being liquidation if the price continues to decline.

On-chain data reveals that Traders at this level are over-leveraged, holding $61.29 million worth of long positions. A potential surge in liquidations could occur if XRP falls below this level.

Meanwhile, $3.358 is another key liquidation level, where traders have built $104 million worth of short positions. This indicates that short-term market sentiment remains bearish, whereas in the long term, ongoing accumulation suggests a bullish outlook.

XRP Price Action and Upcoming Levels

According to expert technical analysis, XRP recently broke out of a bullish flag-and-pole pattern but failed to gain momentum, facing strong local resistance at the $3.33 level.

In addition, the asset also formed a bullish inverted head-and-shoulders pattern, which it briefly breached but failed to sustain, falling back into the consolidation zone.

Based on recent price action, XRP can only rally if it breaches and closes a daily candle above the $3.33 level. If this occurs, there is a strong possibility that the asset could soar by 30%, with the price potentially reaching $4.40 or even higher.

Also Read: Shiba Inu Price Surges 25% as SHIB Burn and Whale Activity Spike