The Chainlink price has finally entered a zone that has attracted strong interest from investors and long-term holders. Recently, a well-followed crypto analyst shared a post on X noting that over 2 million LINK tokens were withdrawn from exchanges in the past 48 hours.

Chainlink Price and Rising Trading Volume

The impact of this substantial token withdrawal has already begun to affect the asset’s price. At press time, Chainlink is trading at $23.60, having climbed 14% over the past 24 hours.

This notable withdrawal has not only impacted the Chainlink price but also increased participation from traders and investors. CoinMarketCap data shows that LINK’s 24-hour trading volume has surged by 85% compared to the previous day.

The rising trading volume, along with the price uptick, suggests strong upside momentum in the asset and indicates that the gain may be sustainable.

Looking at the LINK rally, a crypto community shared a post on X noting that the Chainlink price has nicely formed the expected fifth wave to the upside. The post further stated that a decisive break above $25 could trigger a parabolic move, potentially driving the asset toward the $47 level.

Traders Strong Bullish Bet and Key Hurdle

Given the current market sentiment, traders appear to be following the bullish trend, as they are strongly betting on the bullish side.

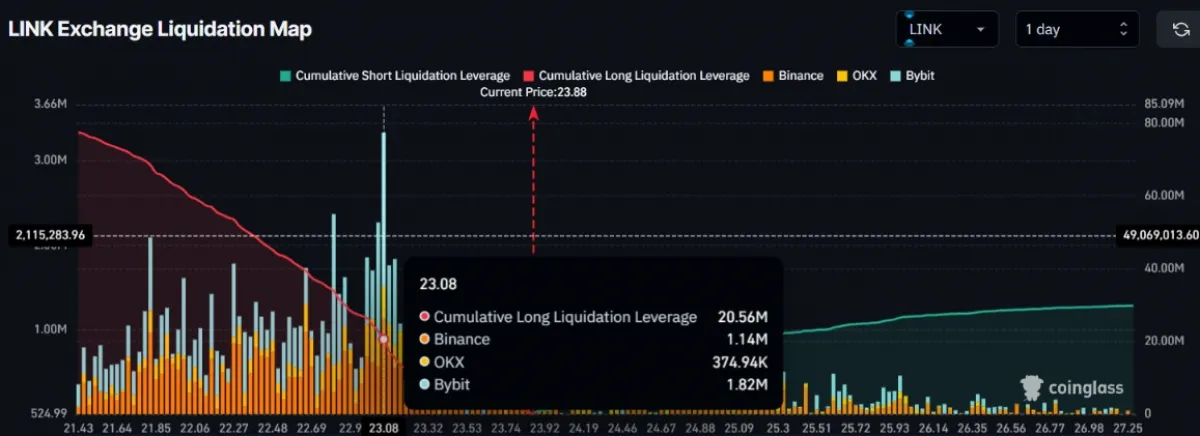

The on-chain analytic tool Coinglass reveals that Chainlink’s major liquidation levels are at $23.08 on the lower side and $24.85 upper side.

These levels are not just liquidation points but also a level where traders are over-leveraged and have built $20.56 million worth of long positions and $12 million worth of short positions.

This metric further indicates that $24.85 appears to be the key level acting as a hurdle for the asset. According to the data, if Chainlink’s price clears this level, it could pave the way for continued upside momentum.

Chainlink (LINK) Price Action and Key Levels to Watch

According to expert technical analysis, Chainlink is in an uptrend on both smaller and larger time frames. This is due to the breakout and successful retest of the key level at $21.85. Additionally, the price has also broken through the local resistance at $22.05.

Despite multiple breakouts and strong participation, the Chainlink price still appears to be consolidating within a tight range between $23.14 and $24.45.

Based on recent price action and historical patterns, LINK’s upside momentum is likely to continue only if the asset breaches the upper boundary of consolidation and closes a four-hour candle above $24.50. If this occurs, Chainlink’s price could soar by 12%, potentially reaching the $27 level or higher.

At present, on both the four-hour and daily time frames, the technical indicator Supertrend has turned green and is hovering below the asset’s price, suggesting that Chainlink is in an uptrend with strong buying pressure.

Whereas, the Relative Strength Index (RSI) stands at 59, indicating healthy bullish momentum while still leaving room for further upside before reaching overbought territory.

Also Read: Altseason 2025: Why Altcoins Are Poised for a Massive Rally