With the current Bitcoin price rally above the $115,000 mark, there is a perception that the long-term holders are making some profit-taking actions, and this has generated speculation over what it will do next. A recent succession of inverted Head and Shoulders (H&S) confirmed a possible bullish trend in the cryptocurrency.

However, an increase in profit take-up among whales may cause short-term volatility, which will eventually influence the future trend of BTC.

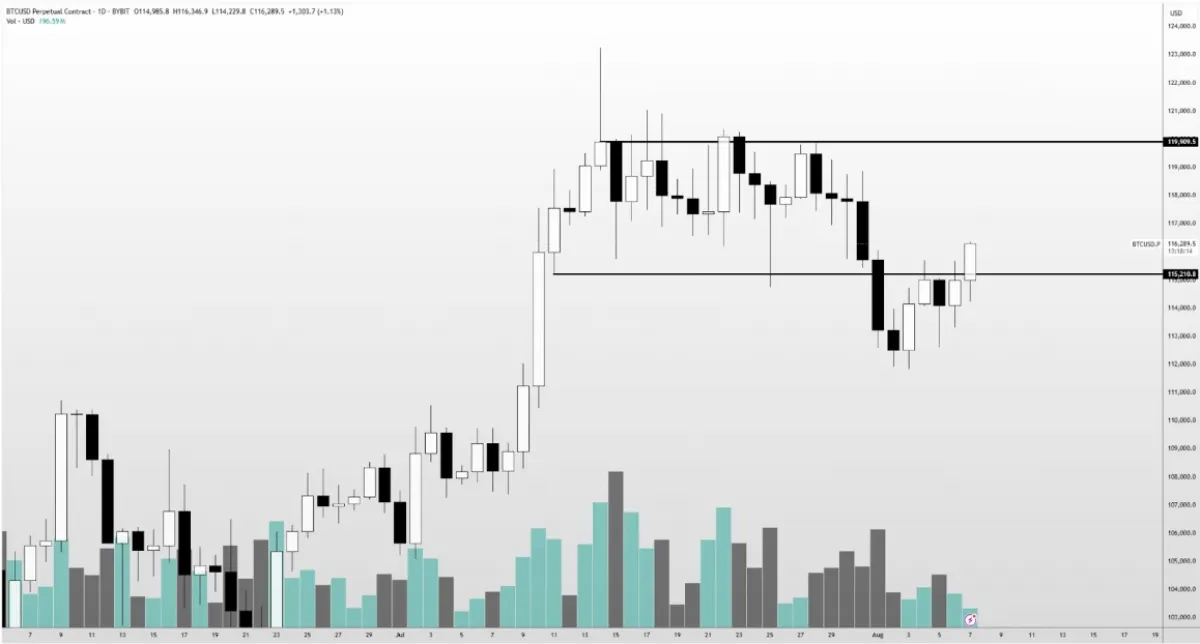

Bitcoin Price Breakout from the Inverted H&S Pattern

Bitcoin price managed to fill a perfect inverted Head and Shoulders (H&S), which is a bullish reversal pattern. The trend was in a declining direction and meant that there was the possibility of later increasing.

It was worth noting that the breakout was at the neckline high of $115,000, which is a very significant resistance point or a current support.

Merlijn Trader emphasized the importance of this breakout. According to Merlijn, this confirmed that the Bitcoin price is likely entering a bullish phase. BTC price has a good position to go higher based on the completion of the pattern and another test of the neckline.

The retest of the $115,000 level proved to be strong support. This added to the conviction that the Bitcoin price will likely move higher in the coming weeks as long as the support level holds.

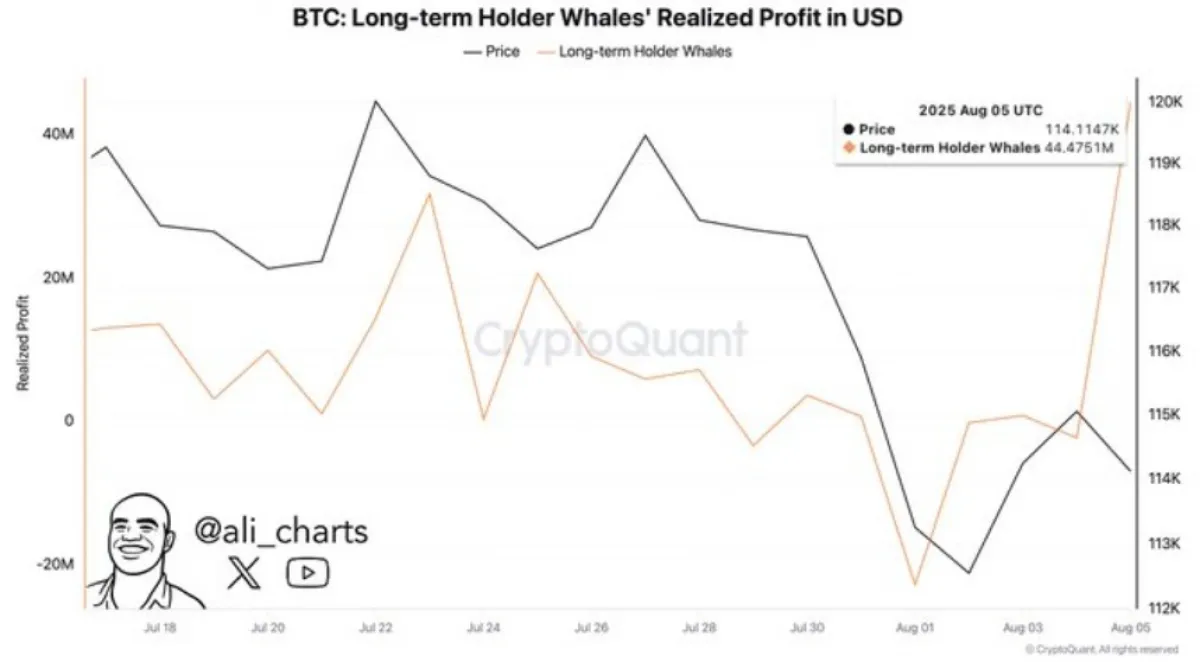

Profit-Taking from Long-Term Holders

Besides the technical breakout, long-term holders, or whales, have taken profits in the Bitcoin price. Crypto analyst Ali Martinez claimed that the two-day profit booking constituted approximately 44.5 million USD by the Bitcoin whales. This followed a breach of important resistance levels in the Bitcoin price, leading to the realization of profits.

Martinez noted a direct correlation between profit-taking and Bitcoin price action. As the Bitcoin price surged above $114,000, whales capitalized on the opportunity to book profits. This is an indication of an impending short-term peak since these whales are used to dictating terms on the market by their selling.

The increase in realized profits may cause short-term volatility. However, Bitcoin’s longer-term bullish outlook remained intact as long as support levels hold.

Analyst’s Bullish Outlook on Bitcoin Short-Term Potential

Altcoin Sherpa, one of the crypto analysts, gave a positive short-term prediction on the Bitcoin price. He noted that the further rise of Bitcoin to the level of $115,700 was indicative of confidence.

After a brief dip below this level, the Bitcoin price quickly recovered and closed back above it with significant volume.

According to Sherpa, this reclaim indicated that the bears have not taken control of the market. If Bitcoin price continues to hold above $115,700, Sherpa expects the price to move toward the next resistance zone near $120,000. This is further supported by the fact that there are bullish engulfing candles and heavy volume, which backs this momentum.

Bitcoin’s Macro Bullish Outlook

In the long term, CryptoELITES provided a macro viewpoint about the future of Bitcoin. The analyst identified Bitcoin breaking out of an ascending triangle pattern that has been in place since 2021.

Once the BTC price exceeds the upper boundary of this pattern, this means that the market sentiment has changed significantly and can start rallying.

CryptoELITES further indicated that the breakout might lead to Bitcoin price surging as high as the $180,000 level. The historical success of comparable Bitcoin breakout patterns supported this macro analysis. As CryptoELITES noted, the fact that Bitcoin is staying above the crucial $115,000 level on weekly candles is paramount in continuing such a bullish uptrend.

Also Read: Binance Coin Price Forms Bullish Cup-and-Handle, Aiming for $1,000