Altcoin season is rapidly unfolding as multiple indicators align in favor of altcoins. The Altcoin Season Index has surged from 20 to 47, suggesting altcoins outperform Bitcoin.

Ethereum ETFs are attracting record inflows, while Bitcoin dominance is falling sharply. Technical patterns, on-chain movements, and sector-wide rallies signal strong market rotation into altcoins.

Ethereum ETFs Lead the Charge as Altcoin Season Heats Up

Ethereum spot ETFs recorded $453 million in net inflows on July 25, extending a 16-day positive streak. BlackRock’s ETHA ETF pulled in a staggering $440 million, highlighting strong investor interest in Ethereum. This surge signals the momentum building around Altcoin season.

By comparison, Bitcoin ETFs posted just $131 million in inflows, led by BlackRock’s IBIT with $92.8 million. ETH ETFs have outperformed BTC ETFs for seven consecutive sessions, reinforcing Ethereum’s rising demand.

Meanwhile, Galaxy Digital sold 80,000 BTC from an account held since 2011. Shortly after this, CEO Mike Novogratz hinted that ETH could outperform BTC. This event follows a similar historical trend: institutional realignment marks altcoin market shifts.

Corporate treasury interest is also pivoting toward altcoins. Bit Origin announced a $500 million DOGE treasury plan. On the other hand, MEI Pharma is committing $100 million to LTC with Charlie Lee joining the strategy.

Altcoin Season Index Surges, Confirming Market Rotation

The Altcoin Season Index has climbed rapidly from 12 to 47 in under 30 days. When the index exceeds 50, the altcoins are performing better than Bitcoin in the past 90 days.

The dominance of BTC has dropped to 60.49% even when the price is around 118K. Conversely, as the early signs of Altcoin season, Ethereum has gained over 5.22% this week. Also, Bitcoin has dropped 0.47% as the overall crypto market cap has increased to $3.88 trillion.

Altcoin strength is expanding. The strongest performing sectors are NFT applications (+170%), Ethereum (+53%), and Gen 1 smart contracts (+40%). This broad momentum implies that money flows into altcoins and not merely circulates in majors.

CoinMarketCap further reports that Polymarket has spent $112 Million to purchase a CFTC-regulated exchange. Also, others in altcoin-centric projects are witnessing institutional money moving in.

Major product upgrades are underway on DeFi platforms, further strengthening investors’ appetite. In historical cycles, Bitcoin’s dominance falling below 60% usually triggers massive altcoin rallies. If this trend continues, a stronger altcoin breakout could unfold in the weeks ahead.

Accumulation Patterns and Phase Cycles Signal Major Altcoin Season

According to Coinvo’s market phase model, crypto has entered Phase 2, where Ethereum outperforms Bitcoin. This is typically followed by money trickling into large caps before a full-scale altcoin season erupts.

Phase 3, focused on large-cap outperformance, is followed by Phase 4, where low-caps and meme coins go parabolic. Analysts note that Phase 1, led by Bitcoin’s surge, is fading as capital rotates into altcoins.

The altcoin season in 2017 and 2021 also started in August following a powerful ETH/BTC reversal. Charts imply that 2025 follows the same path. Also, the accumulation breakout is expected to lead to 150x-250x gains on some altcoins.

This trend is supported by technical analysis. Ethereum’s monthly chart depicted a significant rebound from the necessary support it received against Bitcoin. The RSI also reflects the breakout patterns of 2019, which means a substantial future upside.

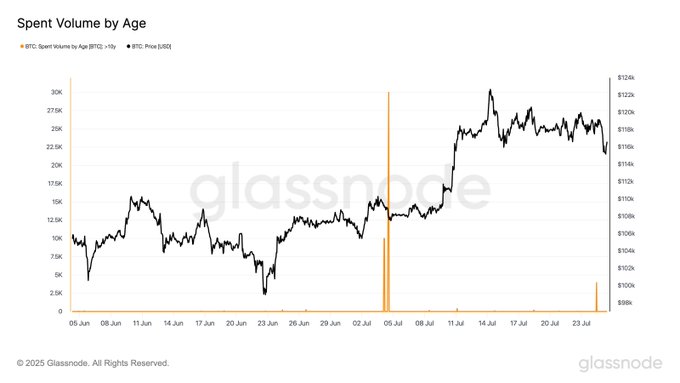

Glassnode on-chain data backs this transition as well. More than 3,900 BTC over 10 years old returned to circulation after 80,000 BTC were transferred on July 4. This sort of activity is usually followed by significant price movement or redistribution.

Also, Bit Digital will raise a billion dollars to expand its ETH exposure. More companies are shifting their crypto strategies toward Ethereum and other altcoins. The expanding upside potential is driving this growing trend.