Coinbase stock price continued its strong bull run this week and reached its all-time high. It surged to $443, giving it a peak market capitalization of $110 billion. This article explores whether the COIN share price will continue the momentum and hit the psychological point at $500.

Crypto Rally Boosts the Coinbase Stock Price

Coinbase stock price jumped to a record high this week as the crypto market rally gained steam. Bitcoin peaked at $123,000 earlier this week, while XRP jumped to a record high. The total market capitalization of all coins jumped to over $4 trillion for the first time.

Coinbase and other centralized and decentralized exchanges thrive when there is a crypto market rally. This happens because these bull runs attract more retail and institutional investors to participate in the industry.

CoinMarketCap data shows that the volume of cryptocurrencies traded in centralized and decentralized exchanges jumped by 24% to $260 billion in the last 24 hours. Coinbase handled over $6.8 billion in the spot market and over $6.6 billion in the derivatives market.

The Coinbase stock price action will depend on what happens in the crypto market in the coming months.

Also Read: Tron Crypto Price Hits 7-Month High, Can TRX Reach $0.45?

Analysts Remain Bullish on Bitcoin

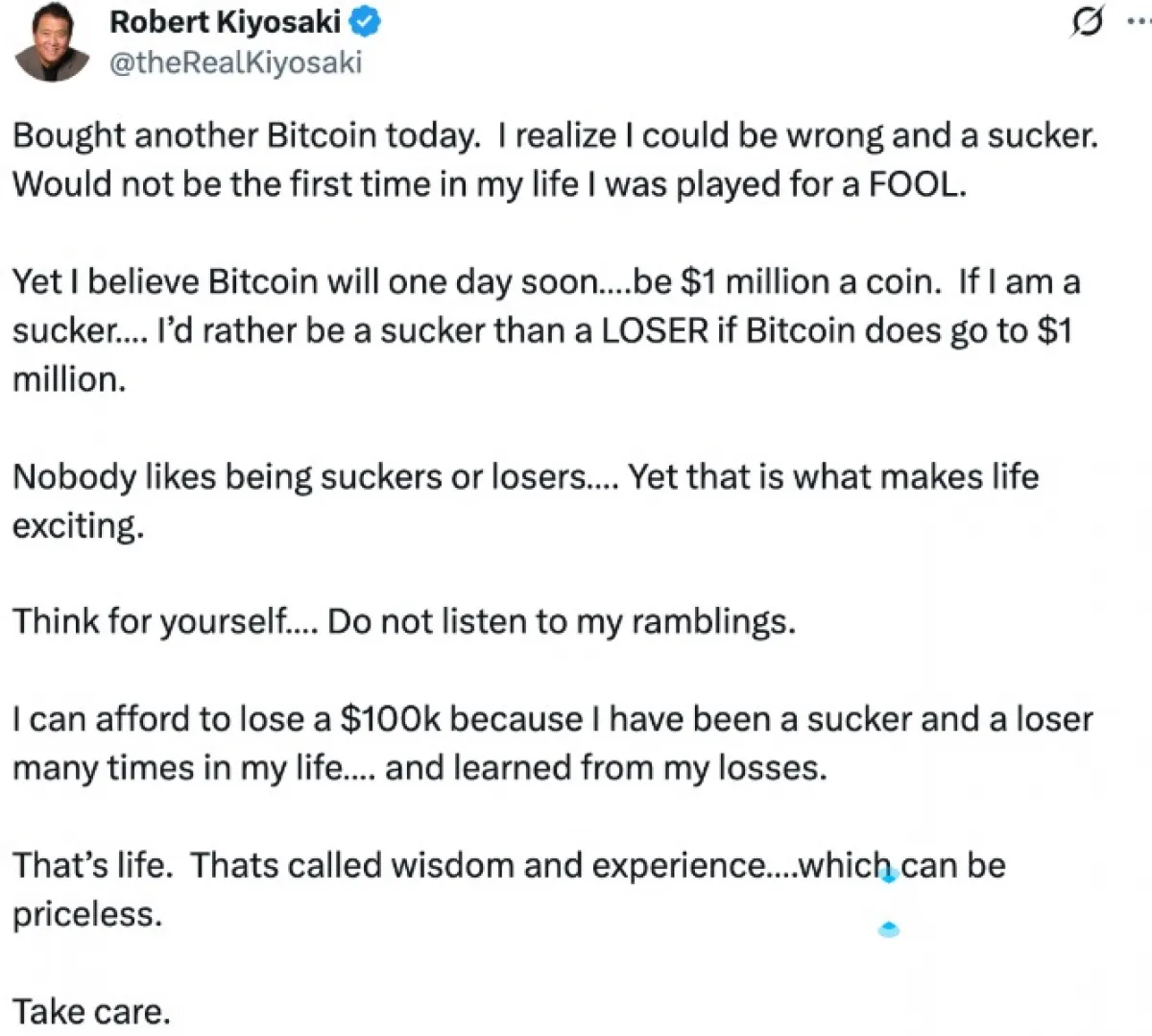

Most analysts are highly bullish on Bitcoin, which is seeing substantial demand at a time when the supply is plummeting. For example, Robert Kiyosaki, author of the Rich Dad, Poor Dad book, believes that Bitcoin will ultimately jump to $1 million.

BlackRock analysts believe that the coin will ultimately jump to over $700,000, while Cathie Wood sees it jumping to over $2.4 million in the long term. Other analysts like Standard Chartered, Tom Lee, and BitWise see it jumping over time.

A strong Bitcoin surge to these target prices would lead to more activity among altcoins. This, in turn, will lead to more volume and revenue for Coinbase.

At the same time, Coinbase is the tenth-biggest corporate owner of Bitcoin with 9,267 holdings worth over $1 billion. A Bitcoin surge to $1 million would push its holdings to over $9.2 billion.

Coinbase is Diversifying its Business

One benefit that Coinbase has is that it has continued to diversify its business over time. This approach means that the company does not make money from just transactions alone.

For example, it recently acquired Deribit, a top player in the derivatives market, as it sought to grow its market share in an industry where it lags its top peers like Binance and Bybit.

Most recently, the company transitioned the Coinbase Wallet to The Base App (TBA), which has more features. It hopes to continue working on the app such that it will become a major player in other industries like payments and gaming.

The wallet will leverage the Base Blockchain, which has become the biggest layer-2 network in the crypto industry. Base handled transactions worth over $30 billion in the last 30 days.

The most recent results showed that Coinbase’s transaction revenues stood at $1.26 billion. Its other business made $698 million, which it expects to keep growing. This segment is made up of segments like stablecoin, blockchain rewards, interest income, and other subscriptions.

COIN Stock Price Technical Analysis

The daily timeframe shows that the Coinbase stock price has jumped in the past few months, coinciding with the ongoing crypto market rally. It recently crossed the important resistance level at $347, the upper side of the cup-and-handle pattern. The C&H pattern had a depth of about 57%.

Coinbase stock has remained above all moving averages, which has supported it. The Relative Strength Index (RSI) has continued soaring, a sign that it has momentum.

Therefore, the most likely scenario is where the stock keeps rising, with the next target being at $550. This target is achieved by measuring the cup’s depth from the breakout point at $347.