The MSTR stock price made a strong bullish breakout this week as Bitcoin surged to a record high. Strategy shares may continue soaring if BTC gains momentum, as technicals and most analysts expect. So, is the 120% yielding MSTY ETF a better buy if BTC and MSTR stocks surge?

MSTR Stock Price is On the Verge of a 20% Surge

Technical analysis points to more MSTR stock surge after it flipped a crucial resistance level into support. The daily chart shows that the coin soared above the key level of $429 this week.

This was an important level because it coincided with the highest point on May 9. It was the upper side of the double-top pattern whose neckline was at $361. A double-top is one of the most popular bearish patterns in technical analysis.

It was also the neckline of the inverse head-and-shoulders pattern, a common bullish reversal sign. Therefore, moving above this level is that it invalidates the bearish double-top outlook and confirms the bullish outlook of the inverse H&S pattern.

MSTR stock is supported by the 50-day and 100-day moving averages, while top oscillators like the MACD and the Relative Strength Index (RSI) have all pointed upwards. Soaring oscillators are a sign that the coin is gaining momentum.

Therefore, if this happens, the next key level to watch will be at $540, its highest point in November last year. This target price is about 20% above the current level.

Bitcoin Price to Be the Main Catalyst for Strategy Stock Surge

The main catalyst for the Strategy stock jump is Bitcoin’s performance. Technical and fundamental analysis points to more Bitcoin gains in the coming months.

First, Bitcoin Treasury companies like Strategy, GameStop, MetaPlanet, Semler Scientific, and The Blockchain Group have continued to accumulate, leading to more demand.

Second, Bitcoin ETF inflows have continued soaring, and have already crossed the important milestone of $54 billion. Also, there are chances that some countries will start buying Bitcoin over time.

At the same time, Bitcoin’s supply continues to dwindle, with those held by exchanges, miners, and over-the-counter exchanges falling.

Technicals suggest that Bitcoin price will jump, potentially to $150,000, as it formed a bullish flag and a cup-and-handle pattern.

Also Read: Standard Chartered Opens BTC & ETH Spot Trading for Institutions

MSTR vs MSTY ETF: Better Buy?

A strong Bitcoin price surge will benefit MSTR stock and that of the Yieldmax MSTR Option Income Strategy ETF (MSTY).

MSTY is a covered call ETF that enables investors to benefit from the Bitcoin and MSTR stock prices, while giving investors monthly dividends. This is notable because Strategy does not pay investors dividends.

It uses a strategy known as covered calls. In it, the fund manager invests in a Strategy stock and then writes call options on the stock, taking a premium, which it pays investors as a dividend.

A call option is a financial transaction that gives an investor the right and not the obligation, to buy an asset before an expiry price.

The main risk for the MSTY ETF is when the underlying asset jumps sharply. In this case, it benefits until the strike price is reached.

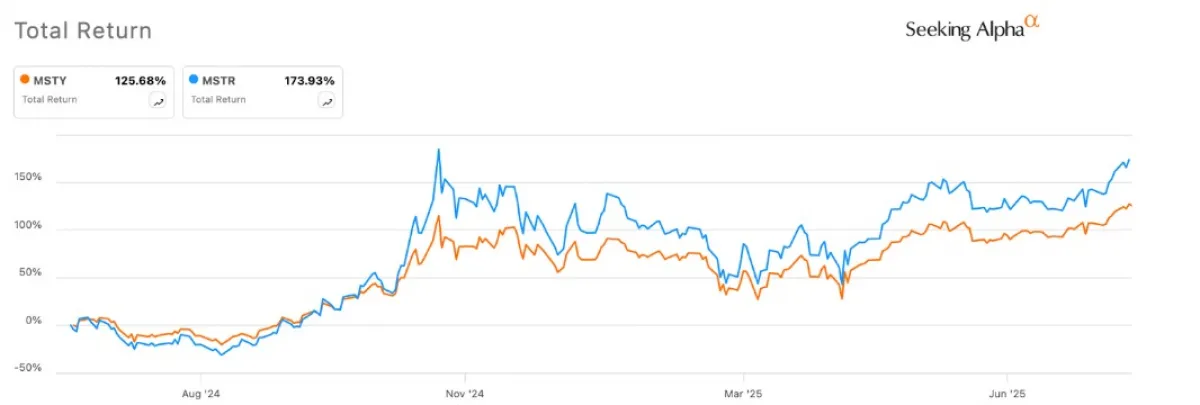

Therefore, while the MSTY ETF has a dividend yield of 120%, it has always underperformed MSTR stock in terms of total return. The chart shows that its total return in the last 12 months was 125%, while the MSTY gained 173%.

Summary

There are high chances that the Bitcoin price will do well in the next few years based on its strong fundamentals and technicals. If this happens, there is a likelihood that Strategy shares will rally as well. Historically, they often do better than BTC.

While MSTY ETF has high dividends, history shows that covered call ETFs underperform their underlying asset. For example, the JEPQ ETF always lags behind the Nasdaq 100 in terms of total returns.