The Strategy stock price drifted upwards on Thursday, July 10, helped by the ongoing crypto market rally. MSTR jumped for two consecutive days to its highest level since May 2022. The stock is nearing a bullish breakout as technical analysis points to Bitcoin surging to $150,000.

Strategy Stock Technicals Signal a Breakout

The daily timeframe shows that the MSTR stock price has rebounded in the past few months. It moved from a low of $230 in April to a high of $413.

The stock has jumped above the 50-day and 100-day Exponential Moving Averages (EMA). Remaining above these averages is a sign that bulls are in control.

The strategy stock price has formed an inverse head-and-shoulders pattern. This pattern comprises a head, two shoulders, and a neckline. In this case, the head section is at $230, while the neckline is at $426.

Therefore, technicals suggest that the stock is on the cusp of a strong bullish breakout. In this case, a breakout above the neckline at $426 will point to more gains. A move above this level will indicate further gains, potentially reaching the resistance at $542, the highest level reached on November 21, which is 31% above the current level.

Bitcoin Rally: The Key Catalyst

The most likely catalyst for the Strategy stock price is Bitcoin’s performance, given its substantial holdings. Fundamentals and technicals suggest that the Bitcoin price is on the verge of major moves ahead.

The most important data is that Bitcoin demand continues rising, with spot ETFs hitting the $50 billion milestone. BlackRock’s IBIT ETF has over $77 billion in assets, a number that may continue growing this year. Other funds by companies like Fidelity and Ark Invest have continued soaring this year.

Bitcoin demand is also coming from treasury companies, which have risen to 60. The most notable firms are Strategy itself, Mara Holdings, Riot Platforms, MetaPlanet, and Galaxy Digital.

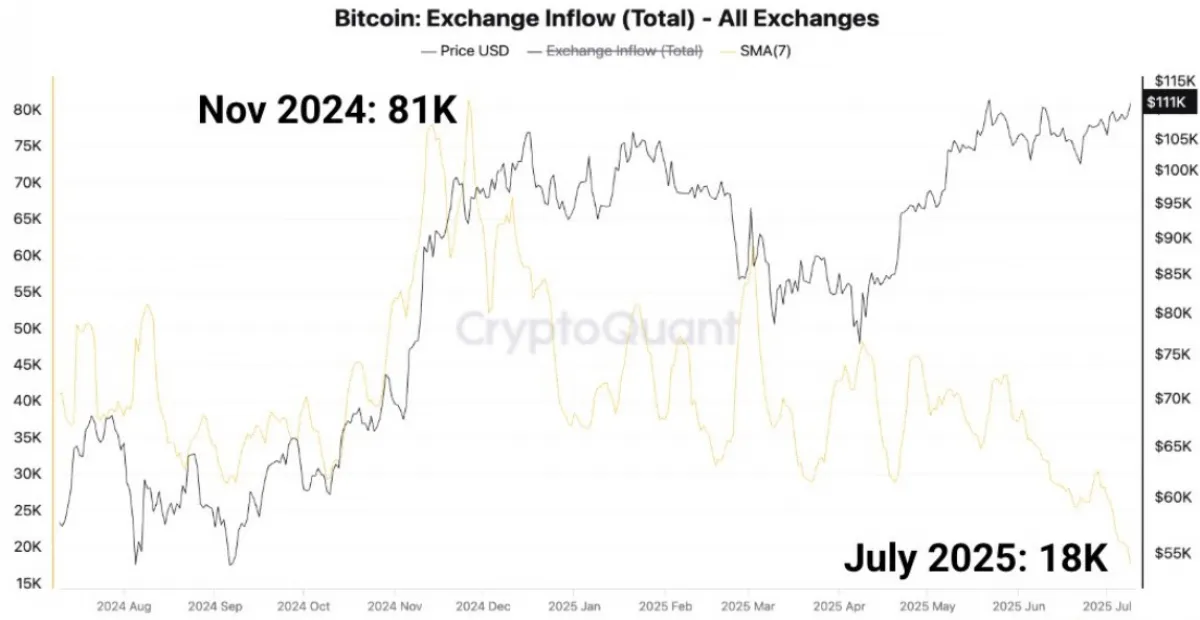

On the other hand, Bitcoin supply continues to fall. CryptoQuant data shows that selling pressure has disappeared, with exchange inflows falling to 18,000, a 78% plunge from the November high. Exchange supply has plunged to an eight-year low.

BTC Price Technicals Suggest More Gains Ahead

Meanwhile, technicals suggest that Bitcoin has more upside. The chart above shows that the coin has formed three key bullish patterns. It has formed an inverse head-and-shoulders pattern whose neckline is at $109,100.

Bitcoin price has also formed a cup-and-handle pattern, another highly bullish pattern. In this case, the cup has a depth of about 30%. Measuring the same distance from the cup’s upper side signals more gains of over $145,000.

BTC price also formed a bullish flag pattern and remains above the 50-day and 100-day moving averages. Therefore, chances are that it will surge to over $145,000, and potentially $150,000 in this crypto bull run.

Impact of Bitcoin’s Surge on MSTR stock

A strong Bitcoin price breakout will likely have a positive impact on the Strategy stock. That’s because MSTR has been the most aggressive Bitcoin accumulators globally.

Data shows that Strategy holds over 597,325 coins valued at over $66.5 billion compared to its market capitalization of $115 billion. This gives it a NAV multiplier of 1.747. This figure means that the company trades at a 1.747 premium to its holdings.

If Bitcoin price surged to $150,000, its current holdings will be worth almost $90 billion. Applying the same 1.747 multiple, it means that its market cap will get to $157 billion. Assuming the current outstanding shares of 279 million remain, then the stock will rise to $563, up by 35% from the current level.

Summary

Strategy stock has lost its correlation with Bitcoin, such that it has remained in a tight range even as Bitcoin soared to a record high. This consolidation may be the calm before the storm ahead of its strong breakout.