Bitcoin price has reached a new all-time high (ATH) of $112,300, marking a remarkable milestone for the cryptocurrency. This price surge comes after a period of uncertainty and market volatility, largely driven by President Donald Trump’s tariff policy.

The surge, which occurred on July 10, 2025, reflects increased investor confidence in Bitcoin, as well as broader changes in market dynamics.

Bitcoin’s price chart displayed a dramatic spike on Wednesday, rising from approximately $108,500 to over $112,000 in just a few hours.

This rapid price movement has caught the attention of traders and investors alike, signaling the growing strength of the cryptocurrency in the face of shifting market conditions.

Federal Reserve’s Dovish Stance

Another key catalyst behind the Bitcoin price surge can be linked to the Federal Reserve’s recent June FOMC minutes. The minutes revealed that most policymakers favor at least one rate cut in 2025.

A few even suggested that a rate cut could come as early as the Fed’s next meeting on July 30, 2025, provided inflation trends continue to moderate.

Traders interpreted the Federal Reserve’s dovish tone as a signal that liquidity conditions may improve later this year. Lower interest rates often drive investors to seek riskier assets, such as Bitcoin, because the opportunity cost of holding these assets becomes lower.

This shift in policy outlook has likely contributed to Bitcoin price recent rally, as more investors look to take advantage of these favorable conditions.

Derivatives Market Shows Growing Interest

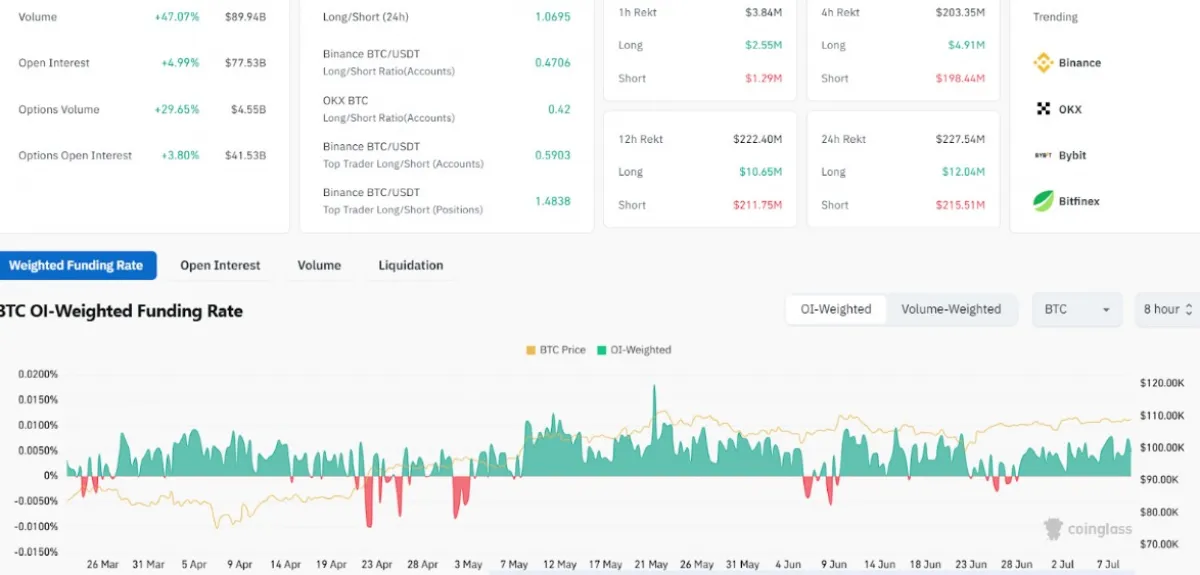

In addition to the sharp rise in Bitcoin’s price, the derivatives market has also seen significant activity. Bitcoin futures and options volumes surged, signaling heightened market engagement.

According to recent data, Bitcoin derivatives volume increased by 47.07%, reaching $89.94 billion. This rise in volume indicates a high level of trading activity, as more investors speculate on Bitcoin’s future price movements.

Open interest in Bitcoin derivatives also grew by 4.99%, reaching $77.53 billion. This suggests that market participants are increasingly confident in Bitcoin’s long-term prospects, with many positioning themselves for larger price movements.

The increase in open interest further underscores growing investor participation in the cryptocurrency market, highlighting the increasing significance of Bitcoin as a financial asset.

Moreover, Bitcoin’s options market also experienced a notable uptick, with options volume climbing by 29.65% to $4.55 billion. The increase in options trading reflects that traders are not only hedging their positions but also capitalizing on Bitcoin’s price volatility.

The rise in options open interest, which grew by 3.80% to $41.53 billion, suggests that investors are preparing for larger market swings and positioning themselves for potential long-term gains.

Also Read: Altseason Incoming? Bitcoin Dominance Drops Below 64%

Liquidations Reflect Market Reversal

The surge in Bitcoin’s price has had significant implications for liquidations in the market. Over the past 24 hours, the total liquidation for Bitcoin reached $227.54 million. A majority of these liquidations, around $215.51 million, came from short positions.

This indicates that many traders who had bet against Bitcoin’s price were forced to close their positions, as the cryptocurrency soared to new heights.

Meanwhile, market intelligence platform Santiment pointed out that many retail investors had been dropping out of the market in recent days, driven by boredom or disbelief.

However, this shift often marks a key inflection point in crypto markets, as price movements tend to go in the opposite direction of retail sentiment.

The drop in retail participation may have provided an opportunity for institutional investors or “smart money” to enter the market and accumulate more Bitcoin.

The level of interest and the increasing number of holders on the network as Bitcoin price entered its new ATH were also mentioned by Santiment.

When FOMO (fear of missing out) starts to take hold of new holders on the network, it may be the next step in the rally of Bitcoin price in the market. Thus, those looking at the network performance of Bitcoin are attentively monitoring this run-up in price.