The TRUMP coin 4-hour chart was in the $9 range, which acted as a stable foundation earlier, and it did this again when TRUMP rebounded at the beginning of June.

The existing base was able to take the pressure out of the market and give market makers space to enter.

Trump Coin Price Action

Trump coin was trading close to $10.50—A sign that people started buying just a little, and the volume was modest. Moving past the next resistance at $12.26 might indicate that people are now more positive about the asset.

Still, a climb above $13 would give us a true confirmation, as this level has historically stopped TRUMP in earlier uptrends.

Provided the bulls can keep up momentum and lift TRUMP to $13 with good volume, the price might return to the $15–$16 range seen in May.

If the support does not hold the $10.50 mark, traders might find the prices drop to $9.84 for testing. If the TRUMP coin falls beneath that zone, there could be more risks for it to fall toward $8.00.

Since the price stayed between $9.84 and $12.26, traders could expect the market to go through some periods of compression before it begins to grow.

Monitoring price until it hits $9.84 for support, $12.26 for resistance, and $13 as a point for bullish breakout was key. Momentum continued at these zones because of how prices were either accepted or rejected there.

Can TRUMP Surpass the $9.25 Billion Market Cap?

Over the last three months, the TRUMP coin market cap has stayed between $2 billion and $3 billion, indicating a long trend of consolidating or being undecided.

At this stage, the market movement is narrow, and this pattern often leads to a sharp change in the asset’s price.

This was because the price was not far from the floor, and the market cap was only $2.20B, so more stress was coming.

According to the resistance line at $9.25B, once the consolidation ended, the price could rise.

This kind of coiling has typically been preceded by a strong move in a single direction, and here, a bullish bias could appear if the asset goes clearly above $3 billion.

Nonetheless, if the price sinks below $2 billion, it could lead to a reversal in the trend and break the bullish case.

Over the short term, traders could focus on volume and the daily closing price outside the range as an important sign of the move to come, up to $9.25B or down to below the base.

Also Read: Dogecoin Prediction: Will DOGE Surge 32% or Face More Consolidation?

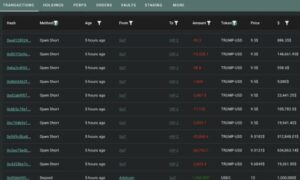

World Liberty Finance Shorts TRUMP Coin with 10x Leverage

There were strong short positions on the TRUMP coin as revealed in the transaction log, with “Self” taking out 10x leveraged shorts by transferring 1,000,000 USDC on Arbitrum on Hyperliquid.

According to the report, World Liberty Finance placed their position against TRUMP at $9.55, with their stop price at $12.49.

Numerous big shorts were recorded in these trades, and one of them was as big as -66,742.7 TRUMP coins with a value of over $634K—may be a sign of strong bears or planned downward actions.

Because of the serious consequences, the trader felt very strongly that the market would go in a downward direction. Still, any increase beyond $12.49 may cause the leveraged short to be liquidated.

Should the price get close to the previous resistance at $16, the trade would face a lot of risks. Alternatively, if TRUMP coin takes off, it could set in motion a short squeeze of the investors who have sold it. The level to pay close attention to is still $12.49.

TRUMP Liquidation Map

Meanwhile, Binance revealed that the TRUMP coin faced both sharp short and long squeezes. If the price falls below $10.30, buyers would be liquidated quickly, but increases past $12, sellers’ accounts would be liquidated.

Many liquidations were at $10.11 to $10.60, mainly for 10x and 25x leverage. This meant that both upward and downward moves could cause chains of people to be forced to sell.

Below $10.30, more than 250K short contracts could be liquidated, while getting above $10.70 might result in over 10K long contracts being closed out.

The way these zones are currently joining suggests possible volatility, and $10.11 and $10.70 should be closely watched for reactions from the market.